In recent years, the taxonomy has established a roadmap for sustainability, providing a clear framework for identifying activities, facilitating the transition to a green economy and reducing the risk of greenwashing.

This is possible because the taxonomy is a classification system created by the European Union, which defines the type of economic activities that can be considered environmentally sustainable, in order to guide investments towards activities that help to meet EU environmental objectives, such as the reduction of Greenhouse Gas emissions or the protection of the environment.

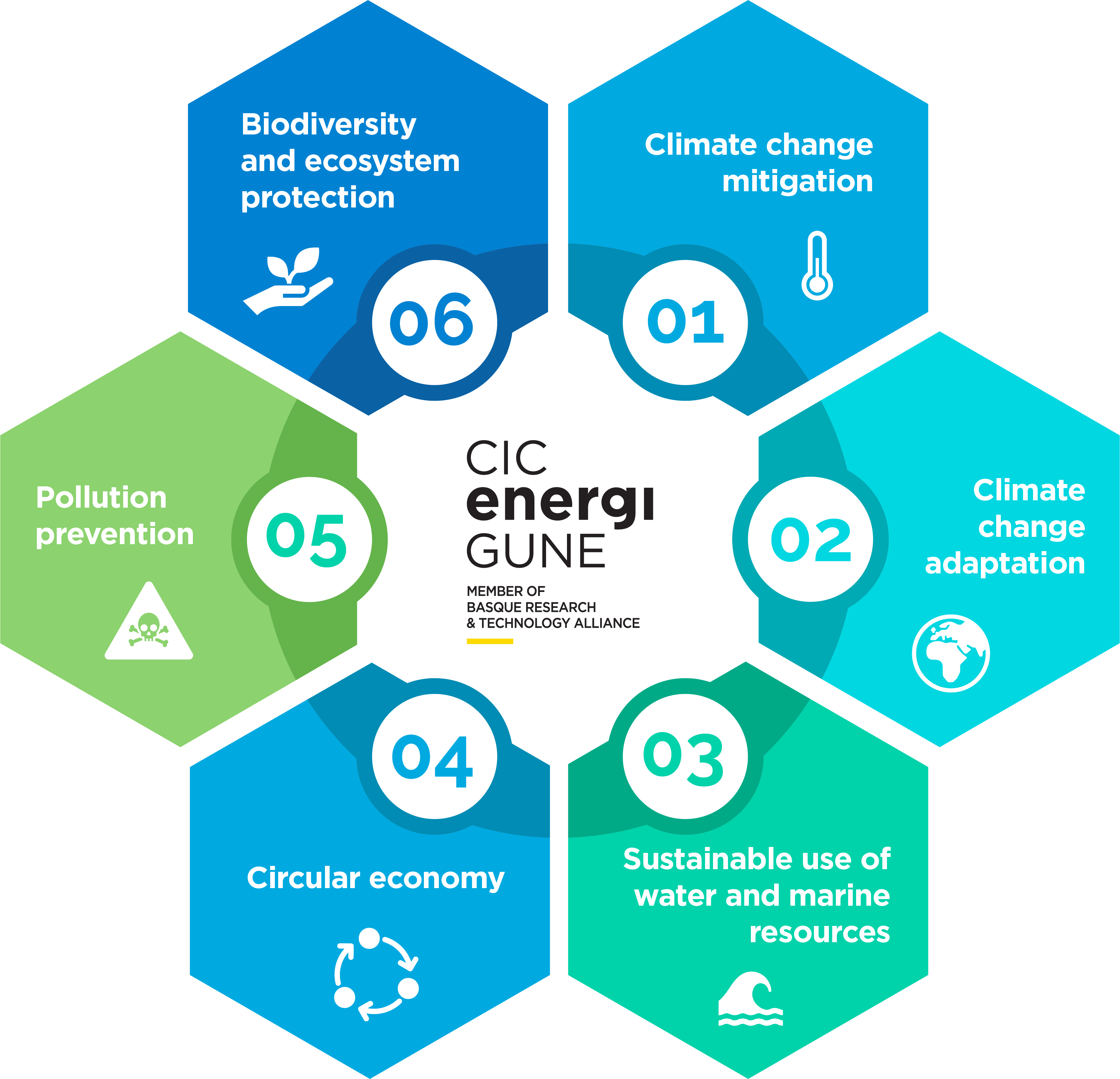

Its general framework, as well as the six environmental objectives that activities must meet, were defined in Regulation (EU) 2020/852, in 2020. These objectives are:

Subsequently, during the years 2021 and 2023, the European Union published different Delegated Acts, which not only covered technical selection criteria for each of these objectives or established disclosure requirements for financial institutions and large companies, but also established important Directives such as the Corporate Sustainability Reporting Directive (CSRD).

It is important to bear in mind two fundamental aspects: the first is that the regulation, delegated acts and directives are designed to be reviewed and updated regularly, so that they can include new activities and adapt to technological and regulatory developments; and the second is that the taxonomy does not establish mandatory environmental performance requirements for companies or financial products.

Since the implementation of Regulation 2020/852, companies, public entities, banks and financial markets have begun to integrate this framework in order to align their strategies with the EU´s environmental objectives. Some of the data highlighted by the European Commission establishes that on average 25% of companies´ capital investments report being aligned with the taxonomy and that companies in sectors such as electricity, reached up to 65% alignment with the taxonomy.

On the other hand, they define that in 2023, 94% of green bonds issued by EU public entities followed the standards of the taxonomy, which reinforces the region´s commitment to financing green projects; and that on average, approximately 85% of assets in major EU banks are aligned with these sustainability metrics.

Finally, it states that 56% of EU funds promote environmental or social characteristics in accordance with the EU sustainable finance disclosure regulation and that funds with investments aligned with the taxonomy have a notable growth in assets under management, driving demand for sustainable options in the financial market.

Battery manufacturing is one of the economic activities capable of facilitating the ecological transition. The taxonomy established in the European Union includes within this activity the manufacture of rechargeable batteries, automotive batteries and accumulators, manufacture of components such as active battery materials, battery cells and electronic components, among others.

The inclusion of this activity in the taxonomy has a significant impact on the energy storage sector, which can be summarized in the following key points:

All this leads to the conclusion that the taxonomy is not only an essential tool for the identification and financing of sustainable projects, but that its impact on sectors such as battery manufacturing is fundamental for the energy transition and the fulfillment of Europe´s climate objectives. The framework that defines it boosts the transparency of the different projects, facilitating investment in green technologies and promoting responsible practices throughout the value chain of strategic sectors such as ours.

Author: Andrea Casas Ocampo, specialist in Sustainability at CIC energiGUNE.

If you want to know the latest trends in energy storage and new developments in research, subscribe.

If you want to join a top-level team, collaborate with specialists in multiple disciplines or tell us about your concerns, don't think twice...