To achieve this, the different battery technology suppliers are working on several development lines to find the solution that best meets the challenges posed by the automotive industry (as well as others related to stationary applications) to adopt new energy storage solutions in their products.

As we have seen in previous blog posts, it seems that the industry´s great expectations are placed on solid-state batteries. However, we will have to wait until the second half of this decade for this promising new generation of batteries to be widely adopted by the industry.

Therefore, in parallel, and with an eye on the short term, the major manufacturers are looking for the best solutions based on conventional lithium-ion technologies.

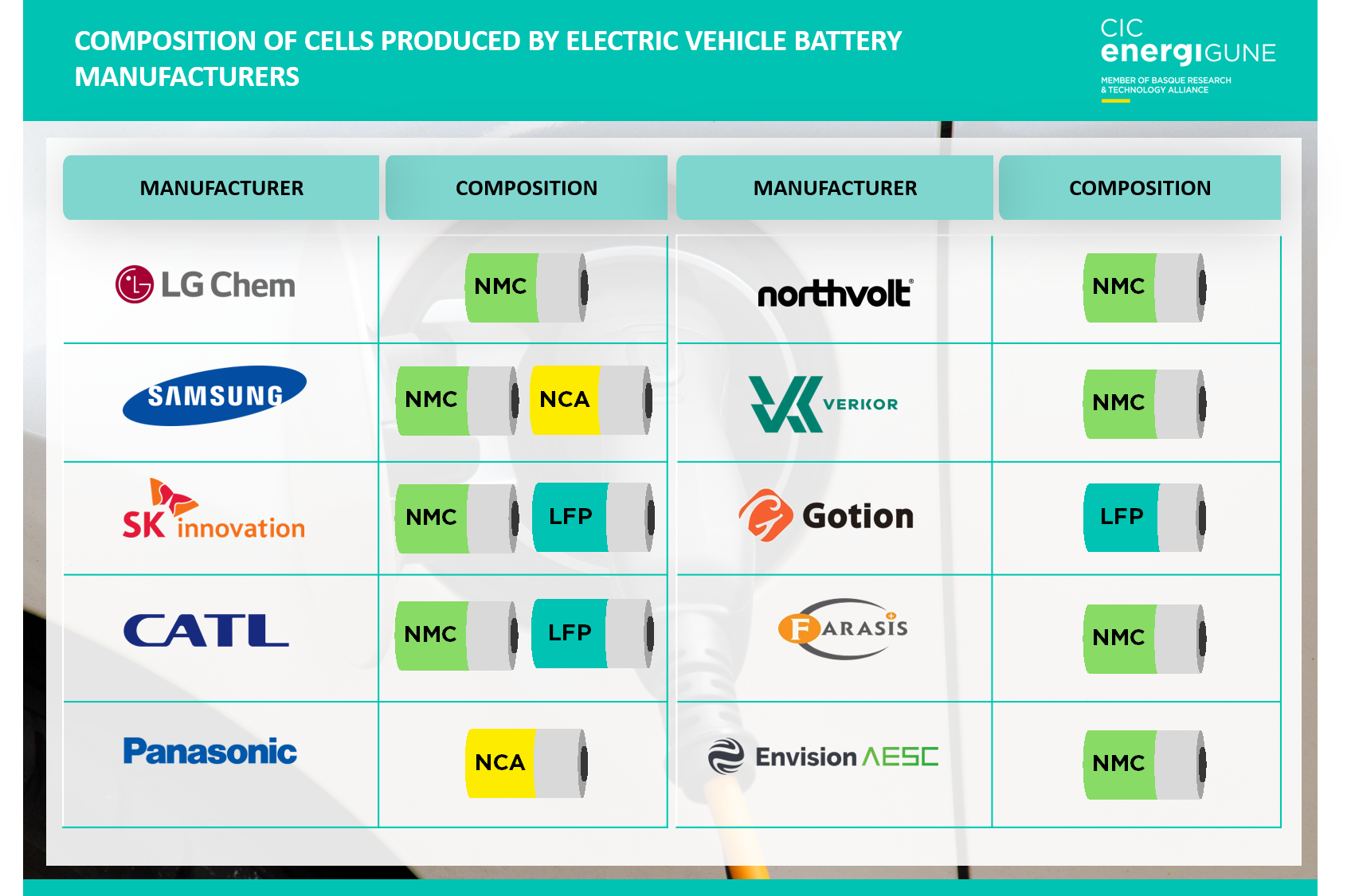

As far as the cathode composition is concerned, there is still no clear commitment to one technology or another, and each manufacturer has its own bet. In fact, there are three main "candidates" to lead the market in the coming years, according to their potential and final application.

Competition between LFP, NMC and NCA cathodes

As far as the "technology" or composition of cathodes for current lithium batteries is concerned, two main trends are gaining ground and leading the bets of different manufacturers: LFP (lithium ferrophosphate) and NMC/NCA batteries (nickel, manganese and cobalt in the first case; nickel, cobalt and aluminum in the second).

The reason why large sectors such as the electric vehicle industry have not yet decided on one or another alternative is due to the fact that they are complementary technologies; they have different advantages and disadvantages that make them more or less attractive depending on the end-use.

For example, if we look at their energy density, NMC cells are in the range of around 150- 250 Wh/kg, depending on the balance between the amount of Ni, Mn and Co used for their composition and the active charge of the cathode; while NCA cells are typically between 200-260 Wh/kg, in some cases exceeding 300 Wh/kg. LFPs, on the other hand, are typically in the 150-170 Wh/kg range, reaching 190-200 Wh/kg in the best case, which means that they need to be designed and manufactured in larger sizes than the other two alternatives, due to their lower energy density, and therefore needing more space and volume.

However, LFP technologies guarantee greater safety in use, thanks to the fact that their composition allows them to be less flammable than NMC and NCA alternatives, as well as being more resistant to high temperatures (but not to extremely low temperatures, where, for example, around -20ºC, LFP batteries can see their nominal capacity reduced by almost half, while NMC and NCA solutions only by around 30%).

Regarding the efficiency in the charging process, again, NMC and NCA batteries show better results than those based on LFP. At room temperature, and taking as a reference the ratio of charging capacity at constant current and their total capacity, it is observed, according to different studies, five times higher charging efficiency of NMC and NCA solutions compared to LFP, which, in theory, means that the charging process can be shortened significantly and less energy can be wasted from the recharge source, but taking into account that the currents used can increase the temperature and compromise the safety of the process compared to LFP recharges.

Finally, concerning another key indicator such as life cycles, the LFPs again proved to be more robust in this case, with a retention in charge capacity of 80% compared to nominal after 3,000 cycles. This figure is somewhat higher than that presented by NCA solutions such as Tesla´s (70% after 3,000 cycles); and much higher than the theoretical life of NMC batteries (with a total of around 2,000 cycles, although their capacity is usually significantly reduced after 1,000 cycles, retaining only around 60% of the nominal capacity).

Different potential applications depending on their results

It is clear that these solutions have "inverse" properties, as the advantages of one are the weaknesses of the other and vice versa. However, their properties, the availability of raw materials, and price are gradually leading to the choice of each of them according to the application or end-use to be given.

Thus, due to their properties, solutions based on NMC and NCA are the ones that seem to have the most significant potential for electric cars, as they allow greater power, greater autonomy and fewer space requirements. On the other hand, limitations in the availability and price of materials mean that the cost of the final battery will increase significantly. At least, it seems that mid-range and high-end electric vehicles to be launched in the next few years will use this technology.

On the other hand, LFP-based batteries may be the choice for larger vehicles, such as buses or heavy transport. Their lower cost, safety and the possibility of using this alternative due to the greater space available inside the vehicle itself mean that they are considered an alternative with more potential for use in this type of transport.