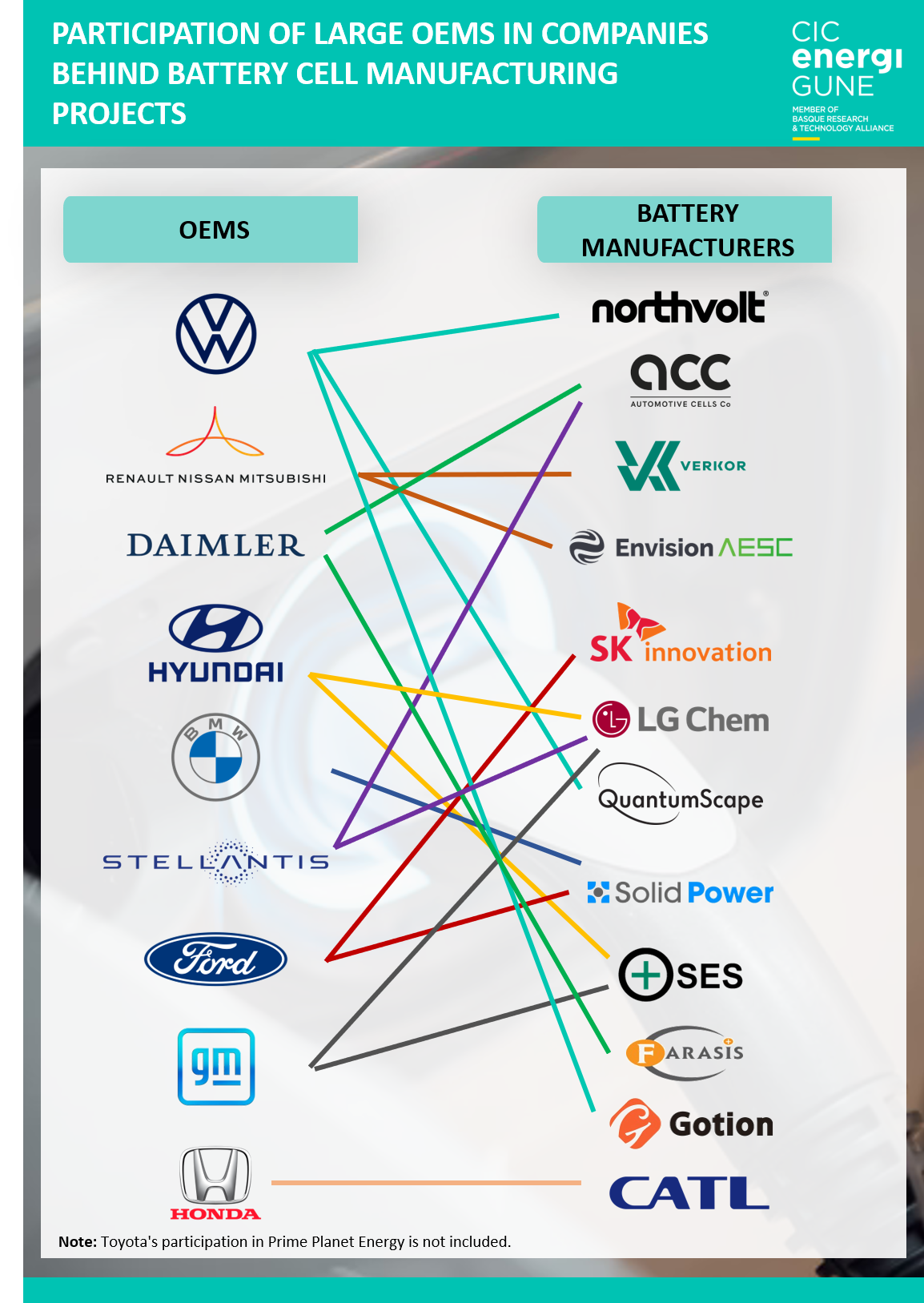

Not surprisingly, the automotive sector is expected to be the major industry from which the demand for batteries will mainly come in the coming years.

As we saw in a previous article where we analyzed the major players behind the state-of-the-art technologies of gigafactories, automotive OEMs have also allied themselves in this bet, providing, mainly, the economic resources that help the development of these cell and battery-pack manufacturing projects. The objective is twofold:

On the one hand, to ensure its demand in the coming years, thus trying to reduce its dependence on third parties. On the other hand, to guarantee the technological know-how associated with the battery sector, a key industry in the coming years that will go beyond the electric vehicle. For all these reasons, almost all the major players are currently taking part in a race to have the maximum possible participation in these developments, in order to be active players in this revolution that is expected in the coming years in the energy sector.

Volkswagen, a key player on the European map

Among all the major manufacturers, in recent months one of the companies that has shown the greatest ambition in this regard is Volkswagen, particularly in relation to the European market.

Last March, the German company announced its intention to have at least six production plants throughout Europe by 2030, with a total capacity of 240 GWh. With this goal in mind, the company has already started to build its way.

On the one hand, Volkswagen is one of the major promoters and investors in Northvolt, one of the references in the battery production sector in Europe. Together, they are working on the launch of projects such as the ones they are jointly setting up in Sweden, as well as on the technological development of their solutions.

On the other hand, Volkswagen is also one of the driving forces behind another of the sector´s incipient technological players: QuantumScape. Together with this company (whose bet is based on solid-state batteries), it has recently announced the establishment of the first solid electrolyte battery factory in Europe.

In addition, the Teutonic company is also working on the development of two other projects. One, at a more advanced stage, consists of a plant in the town of Salzgitter (with an innovative cell research center), which is expected to be in production in 2025. The second, more incipient, involves setting up a battery factory in Spain, with the aim of supplying this technology to their plants in the country, with a special focus on the Seat brand.

In both scenarios (as well as in the rest of the projects proposed by the brand until the target capacity is reached), it remains to be seen who could be its technological partner (as in the cases of Northvolt or Quantumscape). However, it is not ruled out that they will be led by the company itself, which has already announced that it is studying the possibility of manufacturing its own batteries to control "the core" of this technology.

Outside Europe, another of Volkswagen´s big bets is on the Chinese company Gotion, in which it has a stake of around 25%. In fact, it is the spearhead with which the German company seeks to conquer other markets such as Asia. There is even rumors that it could use it as leverage to develop some of the aforementioned projects in Europe.