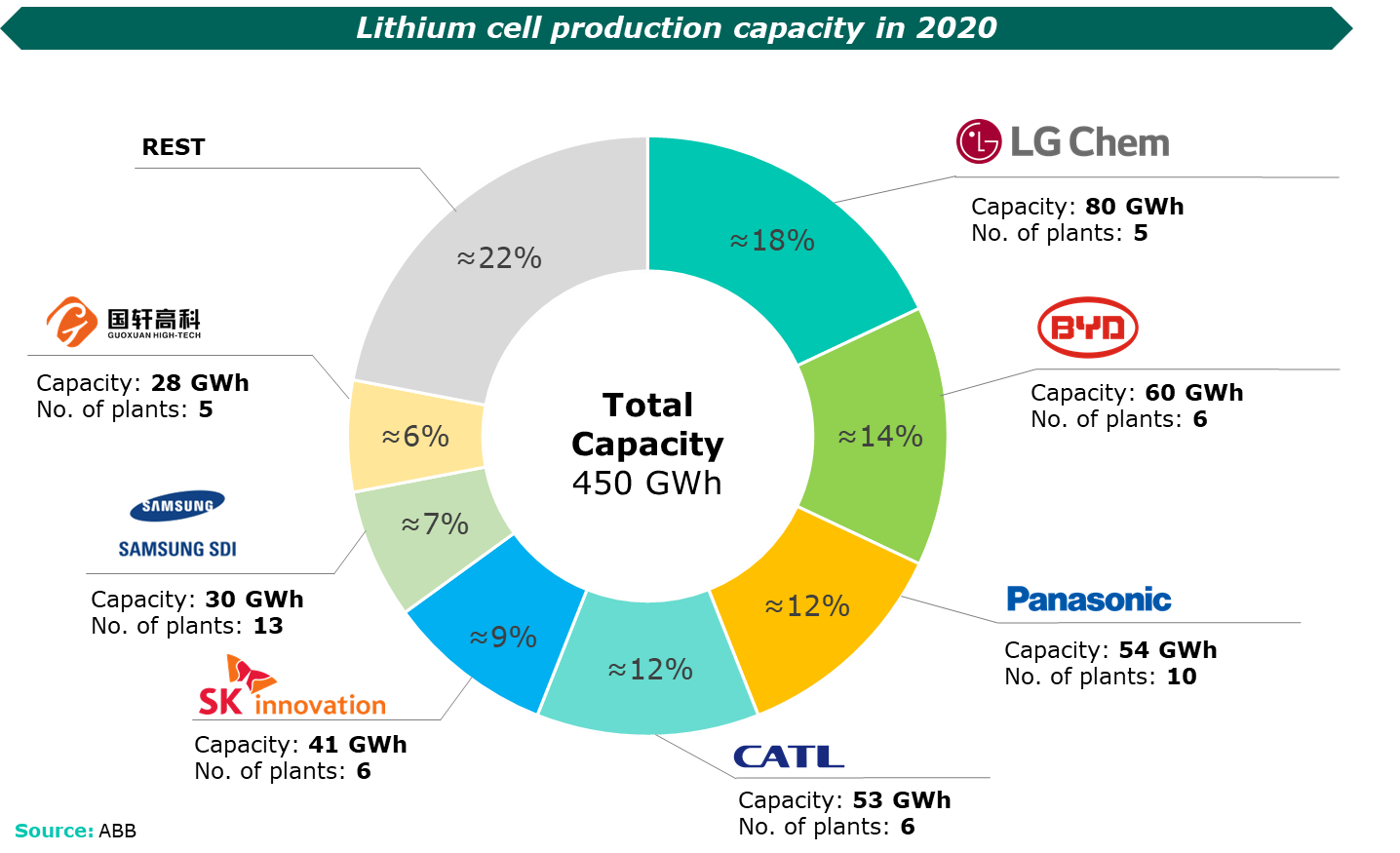

As can be seen in the chart, South Korea´s LG Chem will lead the market in terms of capacity in 2020. This company, which has collaborated with OEMs such as General Motors and Volkswagen, is the only company in the world that currently has a capacity of more than 65 GWh (specifically, around 80 GWh) and expects to be able to, at least, double this value in the coming years through several projects already announced (such as, for example, its major entry into the US market together with General Motors).

The silver medal in 2020 went to China´s BYD, a regular partner of Toyota, which with its six operating plants in China had a global production capacity of around 60 GWh. The intention of this company, which also produces its own electric vehicles and is backed by Warren Buffet, is to, at least, double its capacity in the coming years, through the expansion of its plants in Qinghai and Chongqing or its new project in Shaanxi, for example.

In third place, we find Japan´s Panasonic, Tesla´s usual partner so far, which slightly outperformed China´s CATL, -which presented a capacity of 53 GWh distributed over 6 plants-, thanks to its capacity of 54 GWh distributed over 10 plants (including Tesla´s gigafactory in Nevada).

According to recent press reports, it seems that the latter company aims to turn this situation around and climb to first place in the coming years, through a capacity increase that some sources estimate at more than 230 GWh in the short term.

The north american benchmark and emerging Europe

Despite these figures and the market dominance of these companies, the headlines related to the industry and its players tend to be dominated by a single company: the U.S.-based Tesla.

As some analysts have noted, the company led by Elon Musk has had its own brand image as its main asset to date, as it is the player that has achieved the greatest visibility among the more "generalist" public. And all this, despite the fact that, up to date, it practically lacks its own production capacity, since its only operational gigafactory for electric vehicle cells (the aforementioned one together with Panasonic in Nevada) only has a capacity of ≈35 GWh.

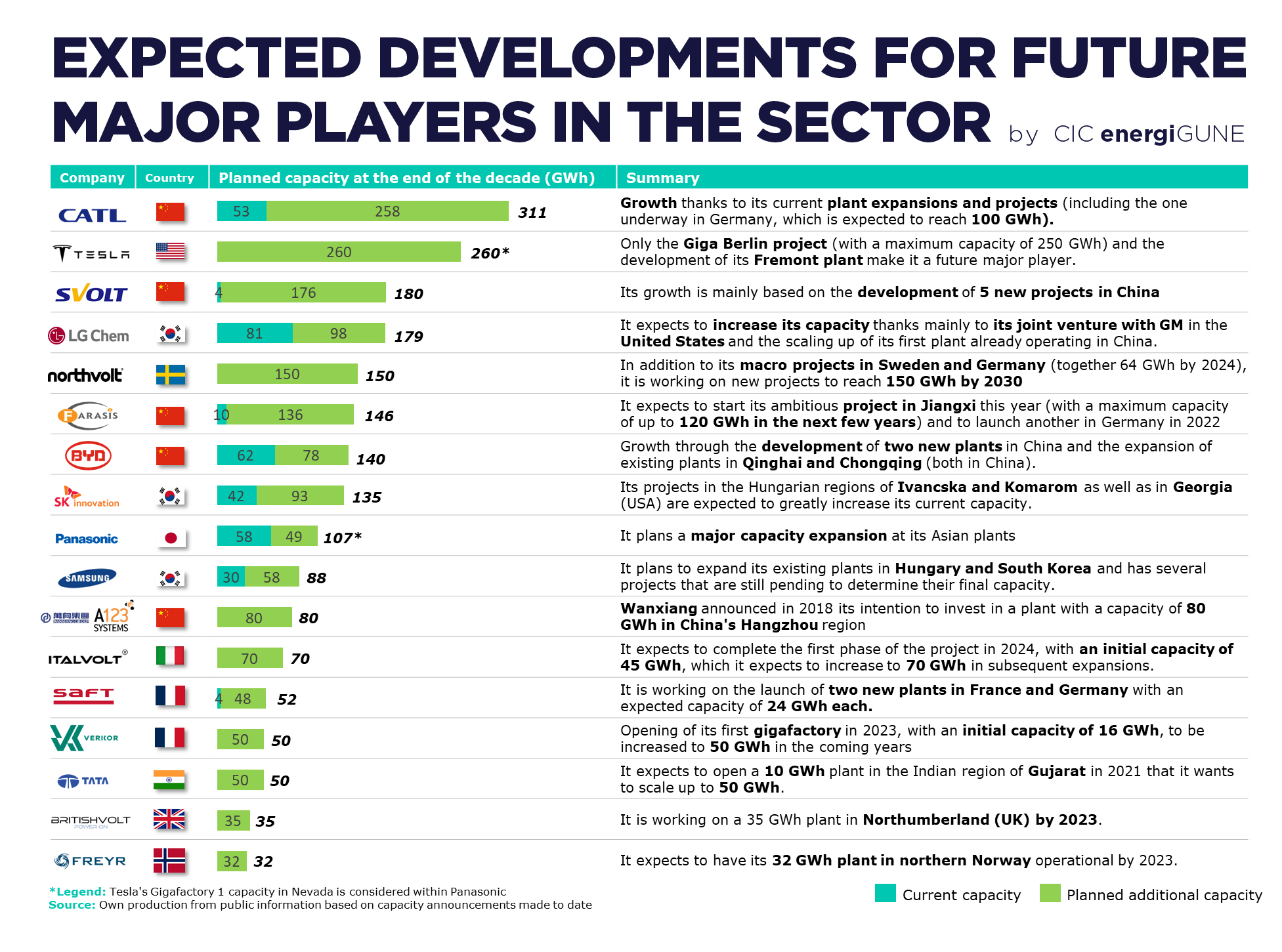

However, Tesla´s plans are to change this situation. In addition to the almost completed gigafactory project in Berlin (which, after numerous complications, is expected to be operational by the end of this year or early next year), there is the new project under development in Austin, Texas (with no confirmation yet of how much its final production capacity could be). Moreover, there are already rumors that Tesla´s sights are set on new locations to continue developing gigafactories in the coming years, such as one in Asia (where countries like China, India, Japan and South Korea are being considered) and another in Europe (the United Kingdom is being strongly considered).

To quantify Tesla´s ambition with these projects, we just need to look at the following data: only the maximum planned capacity of the Berlin gigafactory (estimated up to 250 GWh) would mean that Tesla would have a larger capacity than those of LG Chem, BYD, Panasonic and CATL combined in 2020.

The fact that this first major Tesla project is located in Berlin is no coincidence either, due to the "fever" that, as already noted in previous blog posts, the old continent is having around this type of projects and the electric car industry. That is why, despite their lack of prominence to date, some European players are positioning themselves as potential leaders in the sector in a few years thanks to their plans and projects underway.

In addition to SAFT, which expects to multiply its current capacity of 4 GWh more than tenfold through two projects in France and Germany respectively, other companies are seeking to lead the market from Europe.

This is the case of the Swedish Norhtvolt, launched in 2017 and led by two former Tesla executives with the support of the Swedish Energy Agency and the European Investment Bank. Currently, Northvolt has already committed contracts for €27 billion and has raised more than €17.3 billion in financing with investors as relevant as Volkswagen or Goldman Sachs to launch an estimated production of, at least, 60 GWh before 2024 (thanks to its projects in Sweden and Germany) that could reach 150 GWh by 2030 (which means) it would be at the top of companies in the market by the end of the decade).

Another company with ambitious plans is the French company Verkor. This start-up, which has the support of EIT Innoenergy, IDEC Group and Schneider Electric, announced last year its plans to have a gigafactory from 2023 in the south of France. Its initial capacity will be 16 GWh, but market forecasts mean that the company is confident of being able to expand it to 50 GWh.

These two initiatives have recently been joined by Italvolt, a project promoted by Lars Carlstrom, which aims to locate one of the largest gigafactories in Europe in northern Italy, with a potential capacity of 70 GWh to be reached in the coming years. This is the second project that the developer has announced in Europe, after Bristishvolt´s project, which aims to develop a plant of around 35 GWh in the UK.

In this way, these initiatives seek to ensure that European companies make their mark in the ranking of major players in recent years. In fact, these initiatives, together with others such as Freyr (which is developing a 32 GWh plant to start operating in 2023 in northern Norway) or the one announced by Basquevolt, seek to position themselves as benchmarks in the future, relying to a large extent on 100% European technology, which is key for the regional promotion of the sector and the entire EU value chain.

It is no coincidence that, thanks to these projects (and some other smaller ones), Europe aspires to turn the sector around by 2030, from the current 7% share of world battery production to an estimated 31% by the end of the decade.

The coming future

As we can see, the club of prominent players in the battery cell market is expecting changes and "new members" in the coming years (especially those coming from Europe, from which ambitious new announcements can still be expected).

Although it is yet to be seen how many of the planned and ongoing projects (as well as possible new initiatives to be launched by the aforementioned companies or other new players) will develop, it is clear that no one wants to be left out of the distribution of this market.

For this reason, the 2020 chart we presented above will change significantly as this decade progresses, leaving us with a list with a greater distribution of shares and capacities, highlighting above all the emergence of European producers and the establishment of Tesla as a benchmark in the field.

Thus, taking into account the most important players as of today according to their plans and their more specific projects (and excluding macro-initiatives that are still pending to be seen, such as the gigafactory of up to 500 GWh of Lithium Werks), from CIC energiGUNE we present the following chart that seeks to summarize the expected evolution of capacity (prone to change in case of new announcements or developments) in the coming years for the major players in the battery cell market: