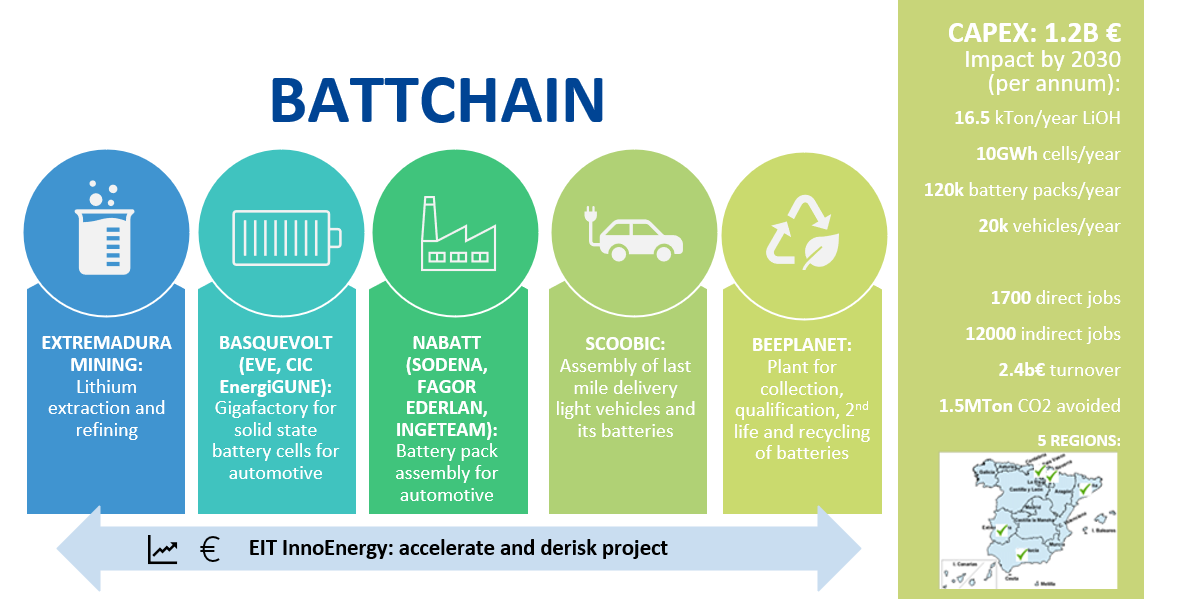

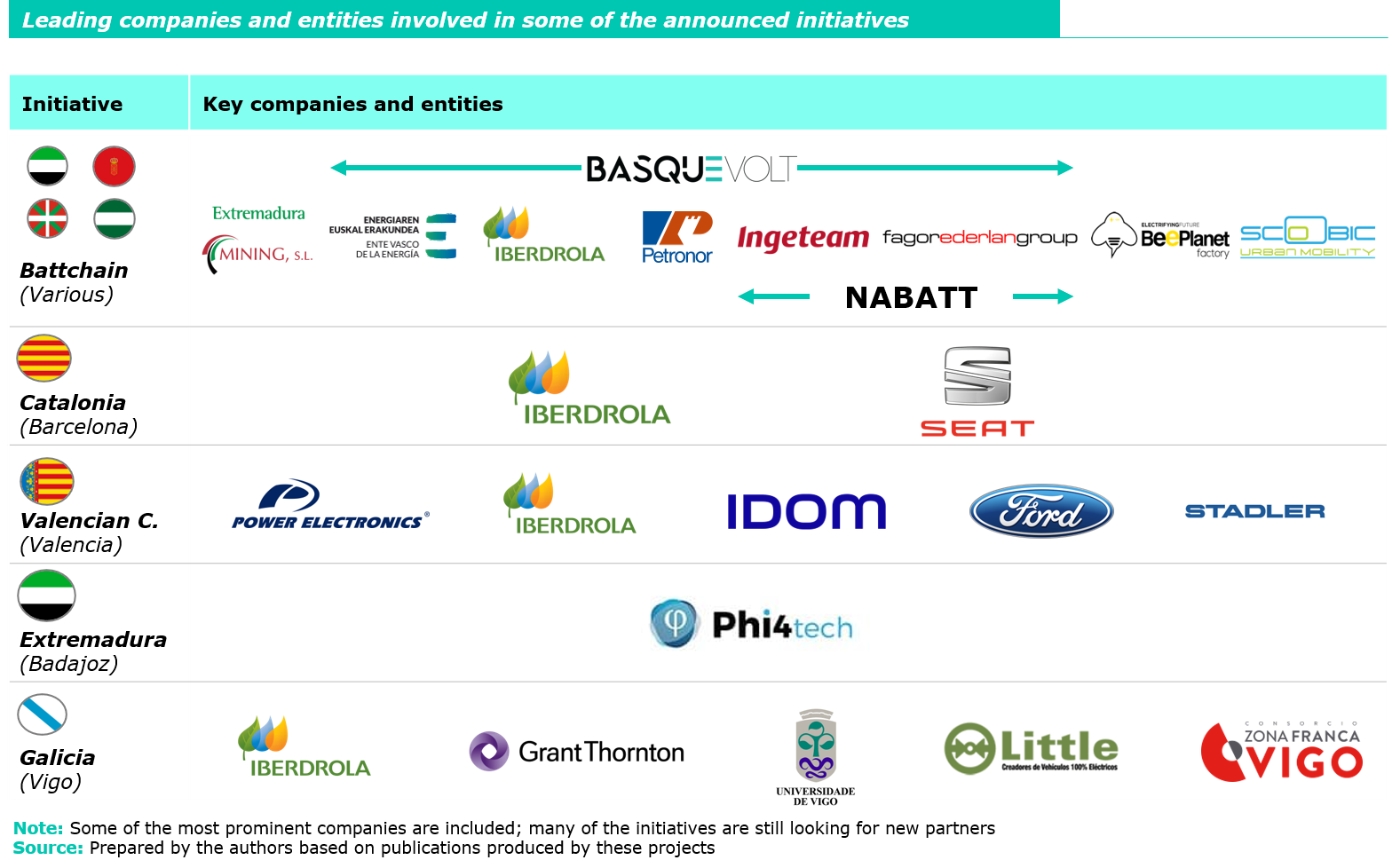

Many of these organizations, in fact, are already involved in synergic investments and developments with the battery industry, within the hydrogen value chain and the production of electrolyzers. For example, Iberdrola and Ingeteam are leading the Iberlyzer project, which, together with the recently announced electrolyzer company developed by Repsol and Sener, aims to launch the electrolyzer industry in Spain.

Several key factors in deciding the final location

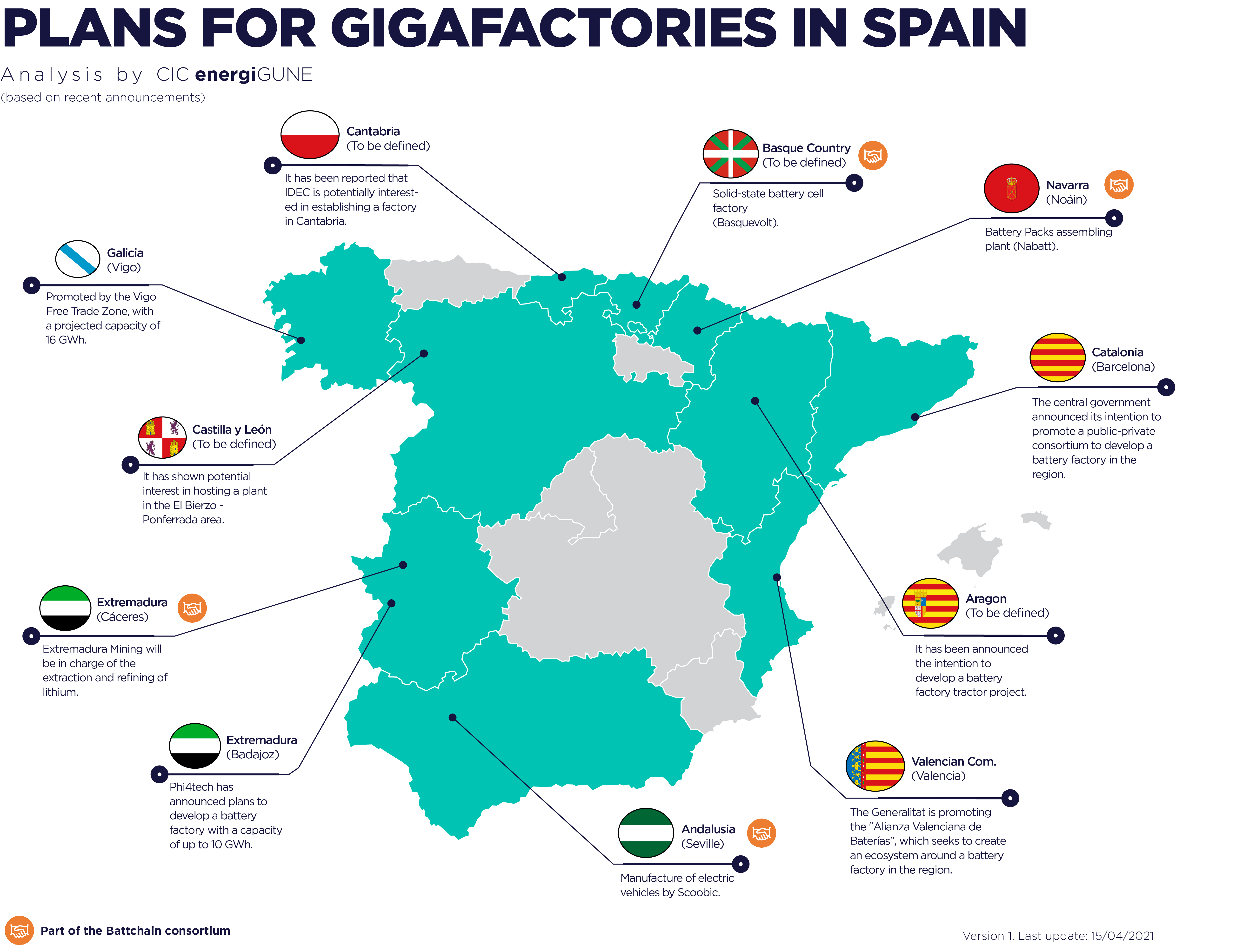

When it comes to determining the final location of the gigafactories needed in the future, different variables can make the final decision in favor of one alternative or another. Although institutional, political and business support is essential to guarantee the feasibility of these projects, other geographical and logistical factors will play a key role in this competition.

Firstly, the geographical proximity of the projects to other key stages of the value chain, such as, for example, lithium extraction or, of course, the OEMS factories. In terms of the first criterion, locations such as Extremadura win out thanks to the existing mines in its territory.

However, it seems that the second criterion may be the most critical in this regard, since different OEMs such as Seat or Renault have emphasized the importance of the factories that supply them with battery packs to be located near their production lines in order to consider starting to produce electric vehicles in them.

In this case, locations such as the Basque Country, Navarre, Castilla y León or Aragón would have a certain advantage thanks to the fact that they have production plants in their territory and are near to those located in neighboring regions. Moreover, other logistical facilities such as rail infrastructures could be an additional element that could tip the balance in one direction or the other.

In short, a few months of regional "battle" lie ahead in which the different projects will seek to attract new partners and investments that will enable them to gain attractiveness and impact in their regions. In any case, the Spanish automotive industry is the big winner, due to the importance and strategic need to have this type of plants in the country in order to face the new challenges that are expected in the sector in the coming years.

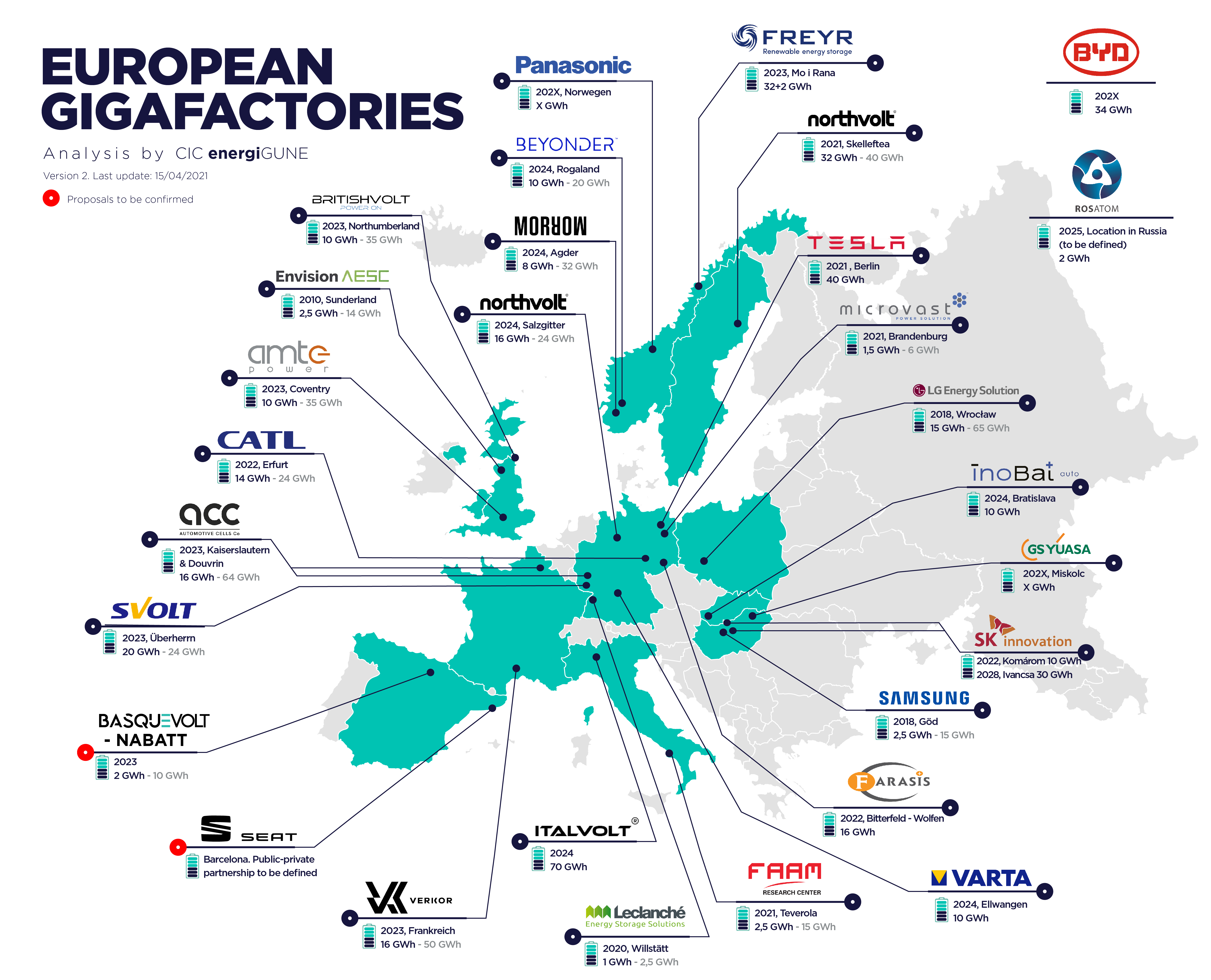

In this way, and despite the incipient status of the initiatives, Spain is expected to contribute 2-3 gigafactories to the foreseen European map (a figure that may vary depending on the capacity and final activity of these plants). Thus, considering the State projects with the highest degree of progress according to the announcements made, this community map could be completed as follows: