|

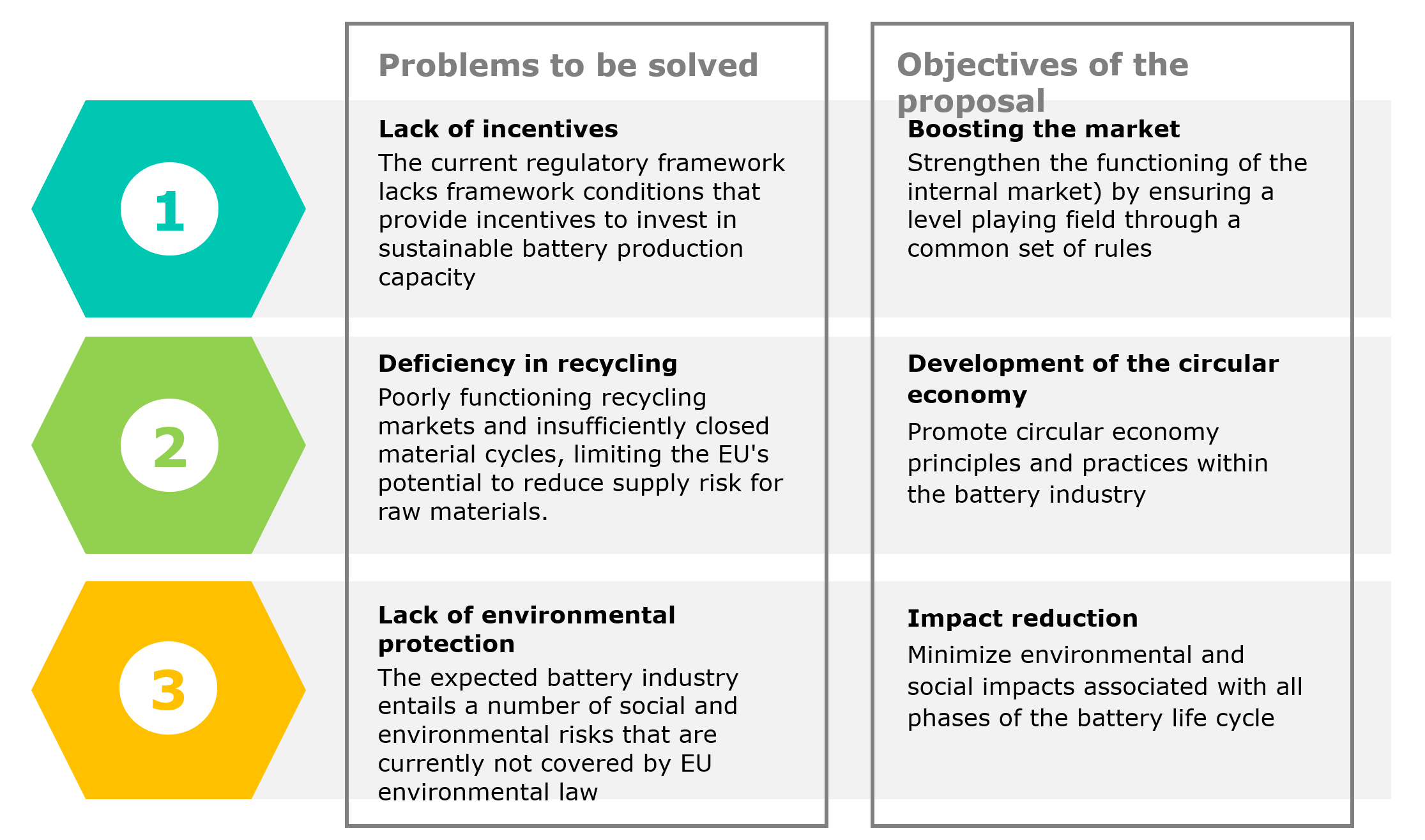

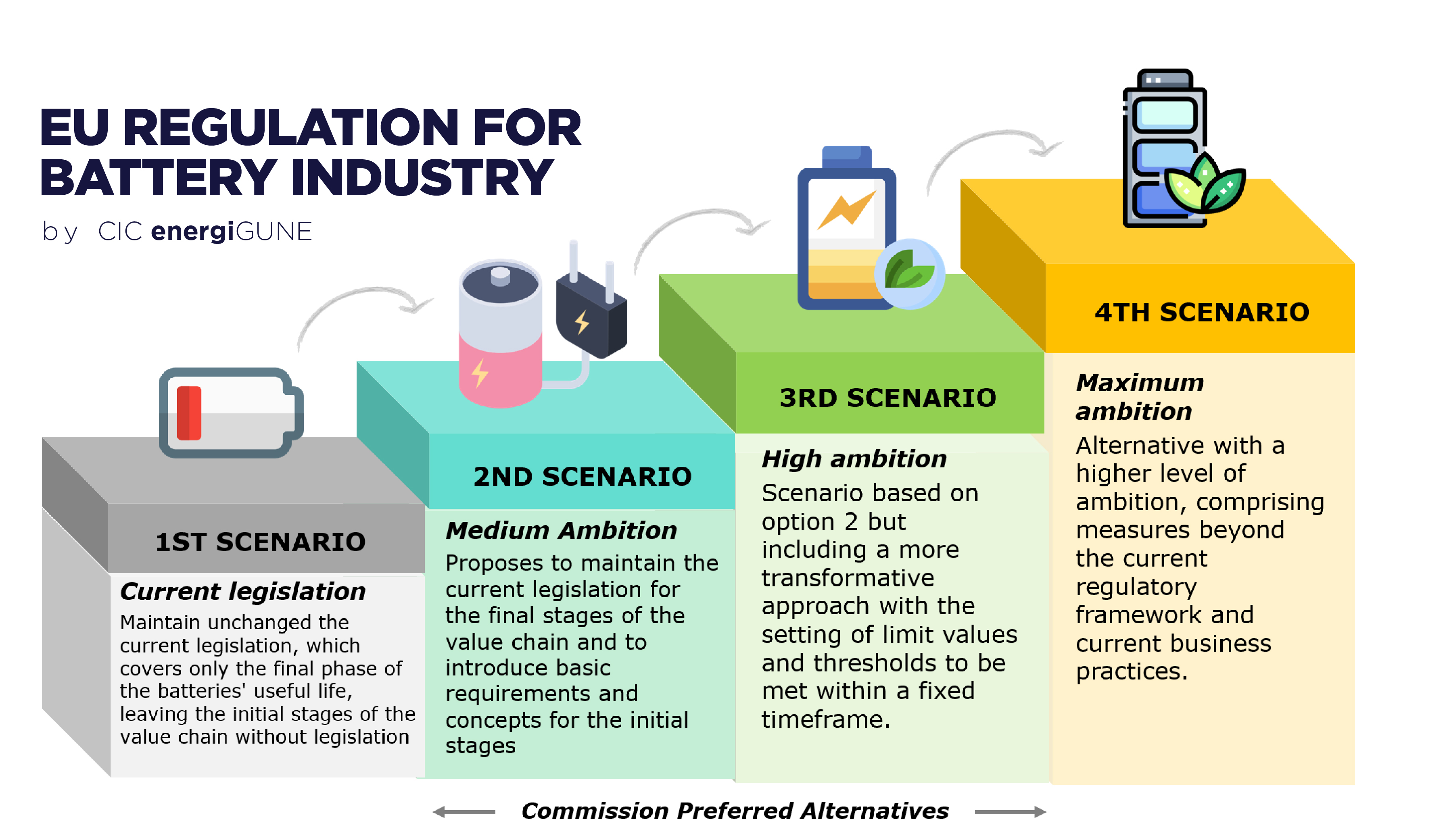

Blocks of mesures

|

Medium ambition level (Option 2)

|

High ambition level (Option 3)

|

Very high ambition level (Option 4)

|

|

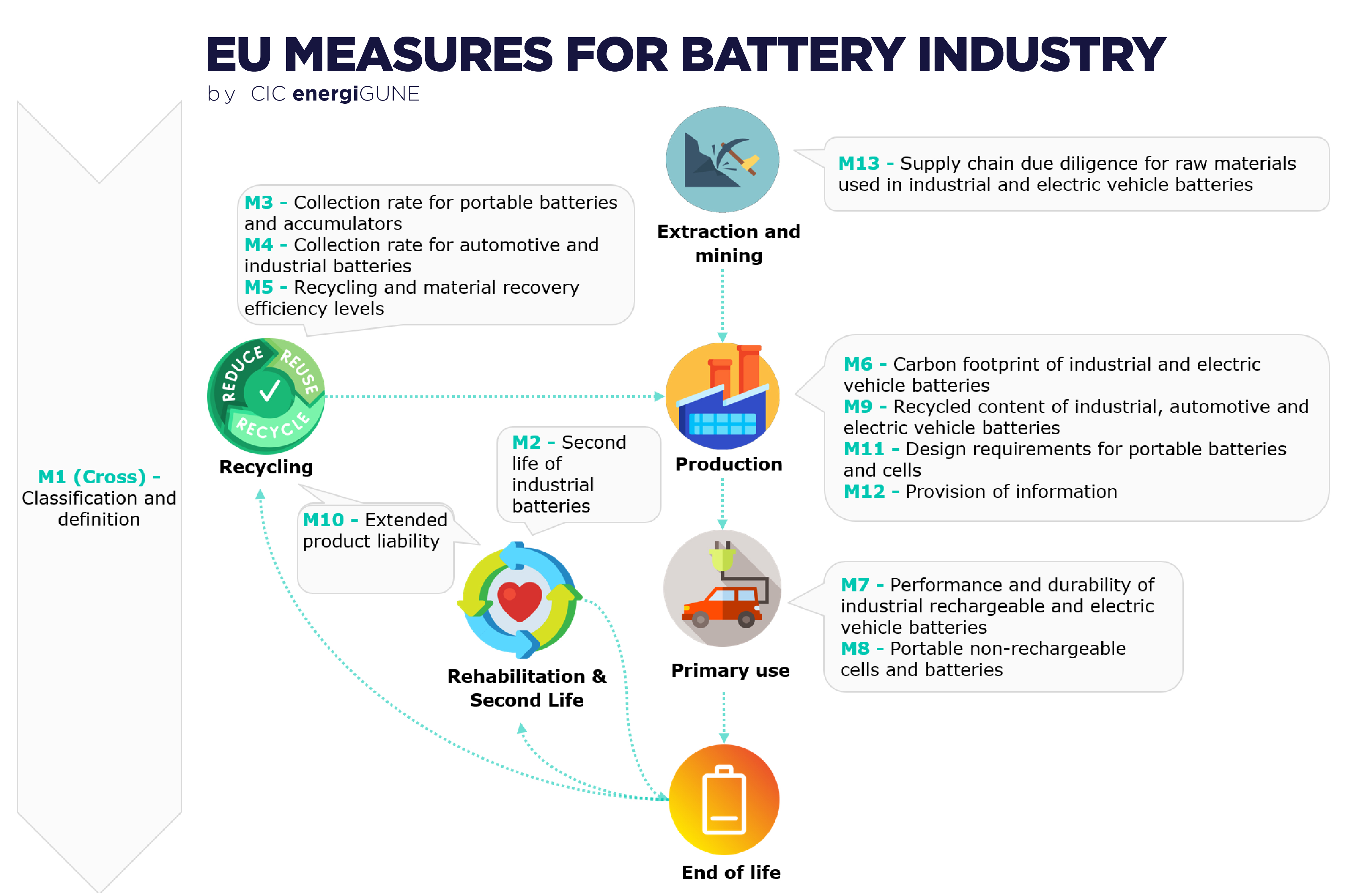

M1 (Cross) – Classification and definition

|

New category corresponding to batteries for electric vehicles. Weight limit of 5 kg to distinguish between portable and industrial batteries.

|

New methodology for calculating collection rates for portable batteries based on the batteries available for collection.

|

--

|

|

M2 – Second life of industrial batteries

|

At the end of their first life, used batteries are considered waste (except for reuse). The adaptation is considered a waste treatment operation. Adapted (second life) batteries are considered new products that must meet the requirements for products when placed on the market.

|

At the end of their first life, used batteries are not considered waste. Adapted (second life) batteries are considered new products that must meet the requirements for products when placed on the market.

|

Preparation for the mandatory second life.

|

|

M3 – Collection rate for portable batteries and accumulators

|

65% collection target by 2025.

|

70% collection target by 2030.

|

75% collection target by 2025.

|

|

M4 – Collection rate for automotive and industrial batteries

|

New notification system for industrial, automotive and electric vehicle batteries.

|

Collection target for light transport vehicle batteries.

|

Explicit collection target for industrial, automotive and electric vehicle batteries.

|

|

M5 – Recycling efficiency and material recovery levels

|

Lithium and Co, Ni, Li and Cu cells and batteries:

Recycling efficiency level for lithium cells and batteries: 65 % by 2025.

Material recovery rates for Co, Ni, Li and Cu: 90 %, 90 %, 35 % and 90 % by 2025, respectively.

Lead and lead-acid cells and batteries:

Recycling efficiency level for lead cells and batteries: 75 % by 2025.

Materials recovery for lead: 90 % by 2025.

|

Lithium and Co, Ni, Li and Cu cells and batteries:

Recycling efficiency level for lithium cells and batteries: 70 % by 2030.

Material recovery rates for Co, Ni, Li and Cu: 95 %, 95 %, 70 % and 95 % by 2030, respectively.

Lead and lead-acid cells and batteries:

Recycling efficiency level for lead batteries: 80 % by 2030.

Material recovery for lead: 95 % by 2030.

|

--

|

|

M6 – Carbon footprint of industrial and electric vehicle batteries

|

Mandatory carbon footprint statement.

|

Performance grades in terms of carbon footprint and carbon caps for batteries as a requirement for market introduction.

|

--

|

|

M7 – Performance and durability of industrial rechargeable and electric vehicle batteries

|

Performance and durability information requirements.

|

Minimum performance and durability requirements for industrial batteries as a condition for market introduction.

|

--

|

|

M8 – Non-rechargeable batteries and portable batteries

|

Technical parameters for the performance and durability of portable primary cells and batteries.

|

Progressive removal of portable primary batteries for general use.

|

Total disposal of primary cells and batteries.

|

|

M9 – Recycled content of industrial, automotive and electric vehicle batteries

|

Mandatory declaration of recycled content levels by 2025.

|

Mandatory levels of recycled content by 2030 and 2035.

|

--

|

|

M10 – Extended product liability

|

Clear specifications for extended producer responsibility obligations for industrial batteries. Minimum standards for extended producer responsibility systems.

|

--

|

--

|

|

M11 – Design requirements for portable cells and batteries

|

Reinforced obligation on the ease of extraction.

|

New obligation on the substitution facility.

|

Interoperability requirement.

|

|

M12 – Provision of information

|

Provision of basic information (on labels, technical documentation or online). Provision of more specific information for end users and economic operators (with selective access).

|

Establishment of an electronic information exchange system for cells and batteries, and a passport system (only for industrial batteries and electric vehicles).

|

--

|

|

M13 - Supply chain diligence for raw materials used in industrial and electric vehicles batteries

|

Voluntary diligence for the supply chain.

|

Mandatory supply chain diligence.

|

--

|