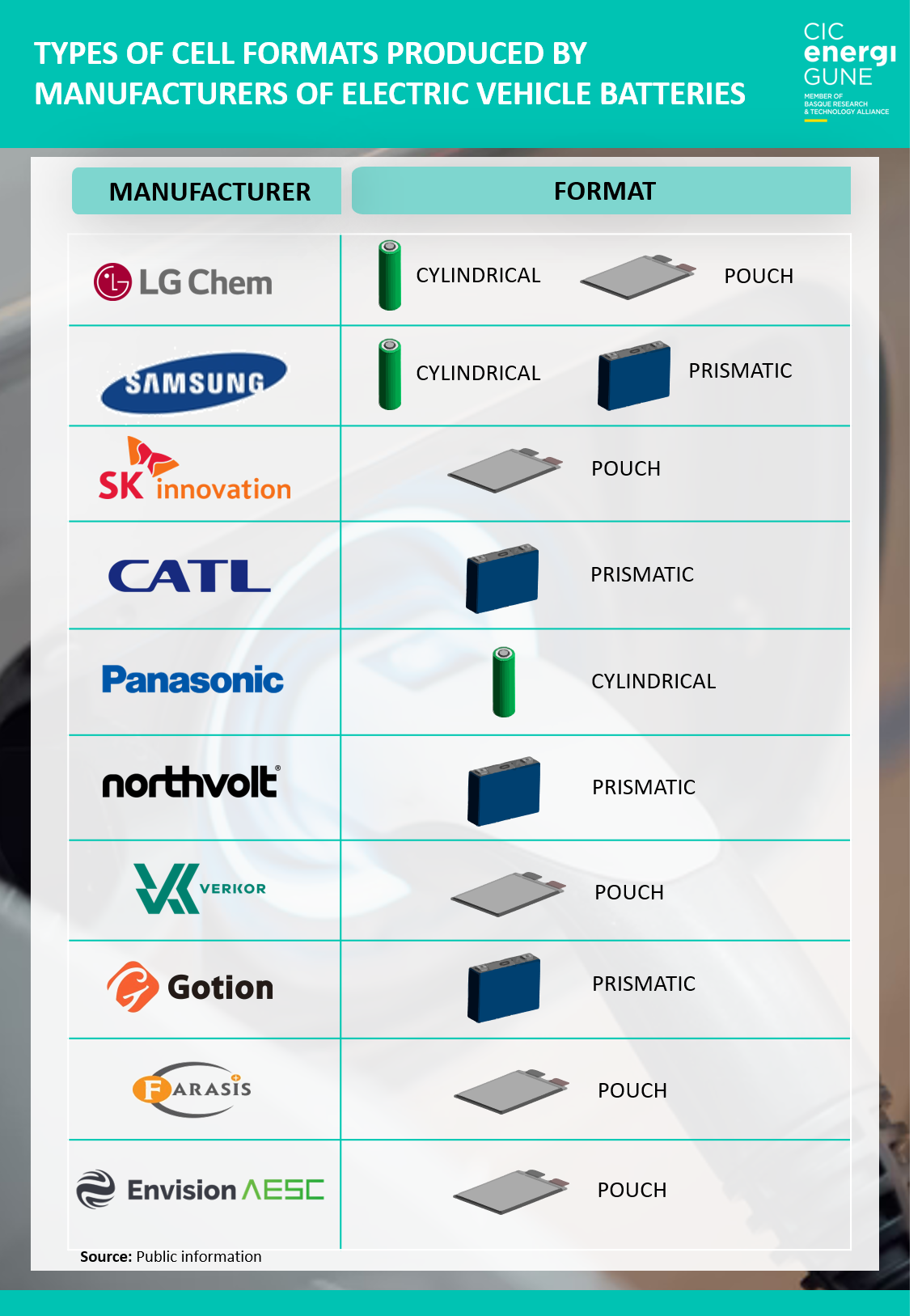

In fact, just as with the composition of the battery cathode, there is no clear winner among the different types of formats. Hence, the main technological suppliers are placing their own bets based on the features that each one considers most relevant for the alternatives.

Currently, there are three main types of configurations that stand out among manufacturers:

- On the one hand, there are the so-called prismatic cells, which are characterized by their packaging capacity thanks to their configuration by stacked "layers".

- On the other hand, there are the pouch cells, whose main feature lies in their light weight thanks to their aluminum coating.

- Finally, there are the cylindrical cells which, thanks to their design and stability, are easily scalable for mass production.

These three options are currently leading the market, especially the first two. According to a study by ADDIONICS, in 2020 the market share for the battery sector was distributed as ≈40% in prismatic format, ≈35% in pouch and 10% in cylindrical, according to the production figures of the world´s major manufacturers.

This variety in the market is due to the advantages and disadvantages offered by each battery format, which makes each end user opt for one or the other depending on their needs. At the moment there is no one format that stands out among the others, but the format that each manufacturer chooses can affect the design of the final product in many different ways. An example of this is how the cell format can affect, for example, the temperature distribution and heat transfer system, thus influencing the thermal management system (BTMS) responsible for the correct operation of the battery temperature.

As a result, each manufacturer is betting on different typologies, in some cases even combining the development of several in parallel.

The different bets of battery manufacturers

Among the manufacturers that are diversifying their options, we find LG Chem and Samsung. Both South Korean companies manufacture cylindrical cells. In the case of LG Chem, it is motivated by supplying the giant Tesla, whose high demand for the Model 3 in China caused LG Chem to double its production capacity.

In parallel, while LG Chem is opting for the manufacture of pouch batteries, Samsung is focusing on prismatic batteries, as it will be responsible for supplying Volkswagen with this type of cells for its electric cars.

The third largest industrial conglomerate in South Korea, SK Innovation, opts for the pouch format, and is responsible for supplying large car manufacturers such as Ford, Mercedes-Benz, Volkswagen, Hyundai and Kia.

Regarding Chinese battery manufacturers, CATL (the world´s largest producer of lithium-ion batteries since 2017) and Gotion (which aims to move from the 28 GWh it currently produces, to 300 GWh in 2025 thanks to partners such as Volkswagen) both opt for the prismatic format.

The third Chinese company involved in cell manufacturing, Farasis, in partnership with OEMs Daimler and Geely, is betting on pouch-type batteries.

Still in Asia, Panasonic, which has become the world´s third-largest lithium battery supplier thanks to its relationship with Tesla, manufactures cylindrical cells, the preferred format of the U.S. giant´s CEO, Elon Musk. Thanks to this, between January and April 2021, the Japanese company´s production reached an output of 9.7GWh, which represents a market share of 14.7%.

Meanwhile, the other Japanese producer, Envision AESC, Nissan´s official supplier for its Leaf model, chooses to manufacture pouch cells, and thanks to the gigafactory that will be inaugurated in 2024 in Sunderland, England, its "pouch" type batteries will help supply the growing European electric car market.

And precisely, leaving behind the clear Asian leadership, and reaching Europe, we find Verkor and Northvolt, which do not agree on the type of format chosen for their battery cells.

While the French start-up has chosen the pouch alternative for the gigafactory that will be built in 2023 in Grenoble, the Swedes at Northvolt have already produced their first 100% European battery cell in prismatic format.