The energy and technology transition is slowly but surely taking center stage. We are seeing it in the many sectoral news and technological advances in areas such as electric mobility or the circular use of battery recycling. It is clear that a more sustainable future is within our reach, so let´s briefly explore the trends and projections for 2025.

Market overview

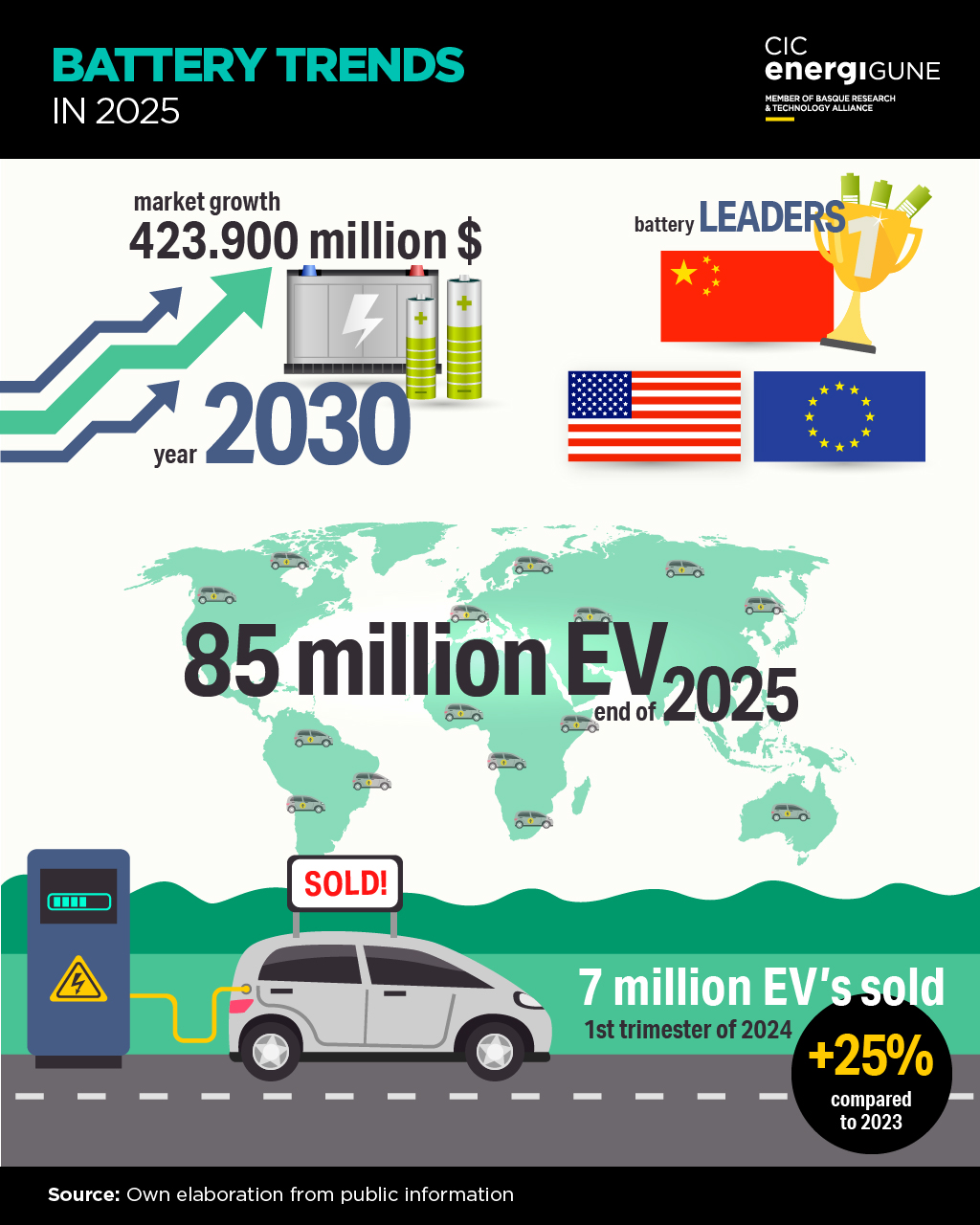

The battery market is growing steadily; in fact, the global battery market is expected to reach $423.9 billion by 2030. This is due to several key factors that will make this industry thrive, such as the growth of electric mobility, renewable energy storage and the unstoppable demand for consumer electricity.

Batteries and Electric Mobility

With the push for government policies favoring zero-emission vehicles, such as tax incentives and stricter regulations on carbon emissions, a massive increase in demand for batteries, especially lithium batteries, to power electric vehicles is expected.

Solid-state batteries are also in full development, and in 2025 we will see the race of the major competitors very close. These batteries will be a revolutionary element for electric vehicles (EVs), especially because they could reduce charging time to 80% in just 15 minutes, not to mention safety and thermal stability. It is true that there are still some challenges ahead, such as cost, scalability, production capacity and the technology itself, but it is becoming a reality that is getting closer and closer.

In terms of global figures, more than 7 million electric cars were sold in the first half of 2024, an increase of nearly 25% over the same period of the previous year. Furthermore, according to forecasts by Gartner, Inc., by the end of 2025, 85 million electric vehicles (EVs) - passenger cars, buses, vans and heavy trucks - are expected to be on the road around the globe.

What does seem clear is that in 2025 this technology will continue to be developed, and we will continue to see how the major competitors collaborate, accelerating the process and making pilots to bring the product to market as soon as possible.

Innovation and Challenges

The regions that are and will continue to echo the most are Asia (China, Japan and South Korea in particular), Europe, the United States and Canada. All play a key role in keeping the battery market on track. We see that China is the leader in battery production and consumption, driven by its huge electric vehicle market, while Europe and the United States follow, although not as closely as expected.

Specifically, China has 85-95% of global manufacturing capacity for battery cathode and anode materials, more than 80% of global solar PV manufacturing capacity and more than 75-90% of global cobalt, graphite and rare earth element processing capacity, according to the World Energy Outlook 2024.

Europe, for its part, has passed strict regulations to meet the European Union´s climate targets, as well as earmarked part of its investment in Gigafactories to become less dependent on Asia and all the production capacity and materials of the aforementioned.

Finally, the United States continues to boost domestic production. With the recent presidency of Donald Trump, the implications could be significant for the global battery market. Potential trade and technology conflicts (especially with China and Europe) could have a notable impact on the race to lead this industry.

If there is one thing they have in common, it is that automotive giants and technology companies from different regions are investing heavily in the battery industry; CATL, LG Chem, Volkswagen, General Motors and Tesla, among others.