Source: ReCell Center

Europe seeks to regulate this macro-industry through a new regulatory framework

One of the major efforts made in recent months has been focused, in a forward-looking approach, on the development of regulations to control the end of the life of these batteries.

Europe has already taken action on the matter through a proposal to change the current regulatory framework, not only to develop the "circularity" of the market, but also to reduce dependence on third territories as far as the supply of raw materials is concerned.

It is a proposal that includes thirteen major blocks of measures covering the entire value chain of the industry with special emphasis on the efficiency levels of recycling and recovery of materials. The objective is to contribute to the protection, preservation and improvement of the quality of the environment by minimizing the negative impact of batteries and capacitors and their waste.

To achieve these goals, the European Directive prohibits the placing of batteries containing certain hazardous substances on the market and defines measures to establish systems aimed at achieving a high level of collection and recycling. It also aims to improve the environmental performance of all operators involved in the life cycle of batteries, such as producers, distributors and end users and, in particular, operators directly participating in the treatment and recycling of waste batteries and capacitors.

The U.S. regulation, on the other hand, complains about the absence of a standardized procedure for the design, materials and chemistries of the batteries that are manufactured. Their proposal includes the introduction of a standardized procedure for battery recycling to help manufacturers understand which materials and designs are most easily recyclable. This is known as the "Designed for Recycling" concept.

In this regard, Spain has the Royal Decree 20/2017, of January 20, which obliges manufacturers to inform consumers about the criteria that will be adopted to ensure that the vehicle they are purchasing will be treated responsibly at the end of its useful life.

Leading international players join the recycling wave

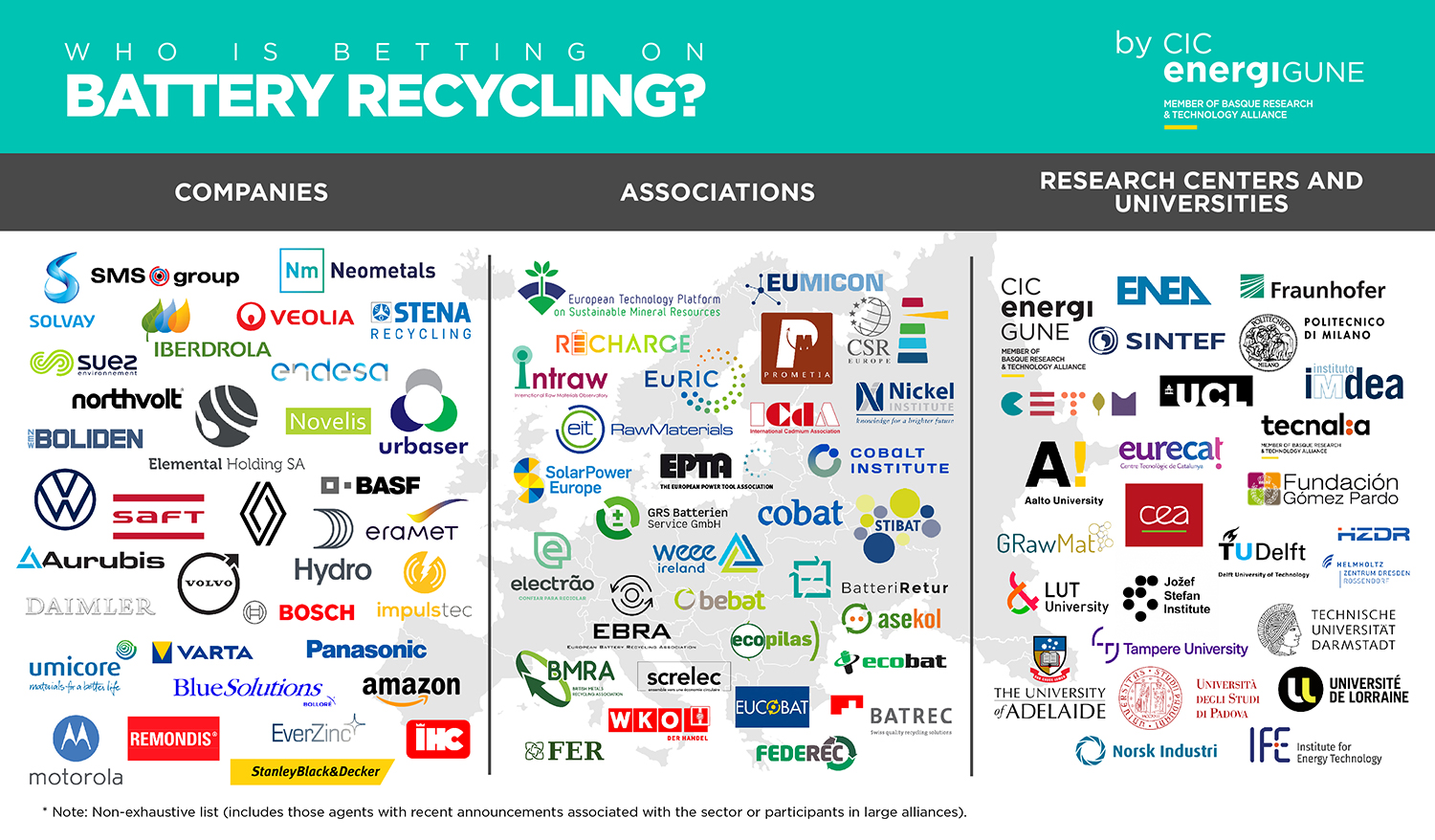

The battery recycling sector requires a transformation and there are many European players that are betting on it to boost the circular economy and create a competitive advantage associated with the knowledge of this growing industry.

One of them is ERMA (European Raw Materials Alliance); an alliance that includes companies, associations, universities and research centers -among them CIC energiGUNE- focused on the recycling industry, and whose activities include, among others, supporting the capacity of the European raw materials industry to extract, design, manufacture and recycle materials.

Among the agents belonging to ERMA, we find the RECHARGE association, which mainly brings together large companies and some associations related to the materials used in batteries, with the intention of promoting and defending the interests of the entire value chain.

Another player, this time directly linked to battery recycling, is Reneos. This is the first European platform for the collection and recycling of electric vehicle batteries. This platform focuses its activity on the collection of batteries and waste in compliance with European guidelines, before giving them a second life through reuse or disassembly for recycling.

Finally, it is worth mentioning other alliances or initiatives that defend to a greater or lesser extent the interests of the recycling industry. Some of them are Eucobat, the European association of national battery collection systems; EBRA, a grouping that aims to develop the highest levels of professionalism in the battery recycling industry; and EuRIC, which, thanks to its strong network of European and national recycling associations, acts as a trusted interface between the industry and the European Union for the exchange of best practices in all matters related to recycling.

Europe´s proliferation of recycling plants

Given the need, sustainability and also the profitability of the battery recycling industry, more and more companies are commercializing new processes for the collection, discharge and dismantling of these batteries.

Not surprisingly, according to a study by the consulting firm Yole Development, during the period from 2020 to 2025 a CAGR of 25% is estimated in the global value of the recycled materials industry for lithium-ion batteries. This would mean, in economic terms, a total market value of close to $1.2 billion by 2025, and some even forecast that, by 2040, this market will reach a value of almost $24 billion.

In Europe, this spread of battery recycling projects is spearheaded by the factory that SMS Group wants to set up together with the Australian company Neometals. It is called "Primobius" and promises effective recycling of lithium-ion batteries.

Meanwhile, Solvay and Veolia are continuing to advance their battery recycling partnership, which began in September 2020, and have announced the establishment of a demonstration plant for recycling battery materials.

In Northern Europe, Sweden has announced the project of a new battery recycling plant, with an investment of more than €24 million by Stena Recycling and will be located in the town of Halmstad.

At the same time, in Central Europe, Volkswagen has recently opened a pilot plant in Salzgitter (Germany) and also, the recycling company Elemental Holding has announced an investment of 182 million euros for the treatment of batteries and other metals containing waste in Poland.

If we focus on southern Europe, recently, the companies Endesa and Urbaser have announced that Spain will have its own battery recycling plant in León in 2023. A project that promises the treatment of 8,000 tons of batteries per year that will be processed through a separation and shredding procedure that will allow the recycling of the materials of the storage system.

In addition to those already mentioned, other plans have been announced for the creation of recycling plants. One of them is Northvolt, which intends to start up a factory capable of recycling 25,000 tons of batteries per year, and also, the one of BASF in Germany, both with the intention of being operational next year.

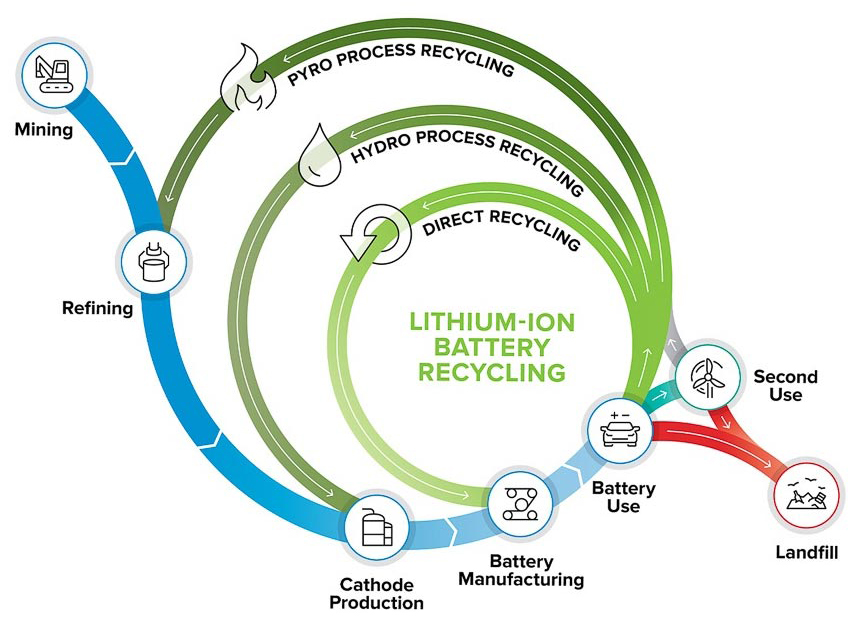

The alternative to recycling: the second life of batteries

Another trend that has arisen as a result of the increased use of batteries is the possibility of reconditioning electric vehicle batteries as an energy storage solution for other applications. This is known as "Second Life Batteries".

Indeed, if the useful life of an electric vehicle battery is estimated at around 8 years, the energy remaining inside the battery cells can be extended by 5 to 10 years, depending on the application in which it is used, until it finally reaches its end of life.

This has led to initiatives such as the one of Enel Group, which has used 90 used Nissan Leaf batteries in an energy storage facility in Melilla. Meanwhile, the energy company Powervault has announced its partnership with Renault to equip domestic energy storage systems based on batteries from retired electric vehicles.

Not only that, Spain has also been a pioneer in Europe by installing the first chargers powered by second-life batteries on the highway linking Madrid and Valencia.

One way or another, the premise is clear. It is necessary to find a solution for the recycling of around 50,000 tons of batteries that are expected to be discarded from 2027; a figure that could even multiply and reach 700,000 tons in 2035.

Hence, one of the main focuses of work and research at centers such as CIC energiGUNE is the advancement of techniques and solutions that promote the development of the recycling industry. Even more so if we want to ensure that the battery sector becomes a reference in terms of sustainability.

Below, as a summary, from CIC energiGUNE we have gathered the classification of the main agents that have announced to be associated to battery recycling: