A roadmap divided into two different regulations that not only seeks to position Europe as a reference in technological development, but also to guarantee its independence in terms of critical raw materials. This is why Ursula von der Leyen, President of the European Commission, announced that the launch and implementation of both the "EU Net-Zero Industry Act" and the "European Critical Raw Materials Act" demonstrate Europe´s ambition to accelerate in this technological race and to maintain its commitment to date. In fact, on the very day of the presentation of the plans, the President of the European Commission acknowledged that "we need a regulatory context that will enable us to scale up the clean energy transition quickly".

This is the main objective of this major regulatory framework that has been approved. Above all, in order to stand up to countries such as the USA and its now famous "Inflation Reduction Act" (IRA), already analyzed in our blog, whose fiscal attractions are arousing the interest of companies with investment plans initially in Europe, such as Volkswagen and its gigafactory in the west of the old continent.

Thus, Europe´s plan with this new regulation is not only to speed up the deployment of investments and developments in the value chain of green technologies in Europe, but also to avoid a possible exodus of companies and knowledge to other regions at a key moment in the "struggle" to lead the future of the energy transition.

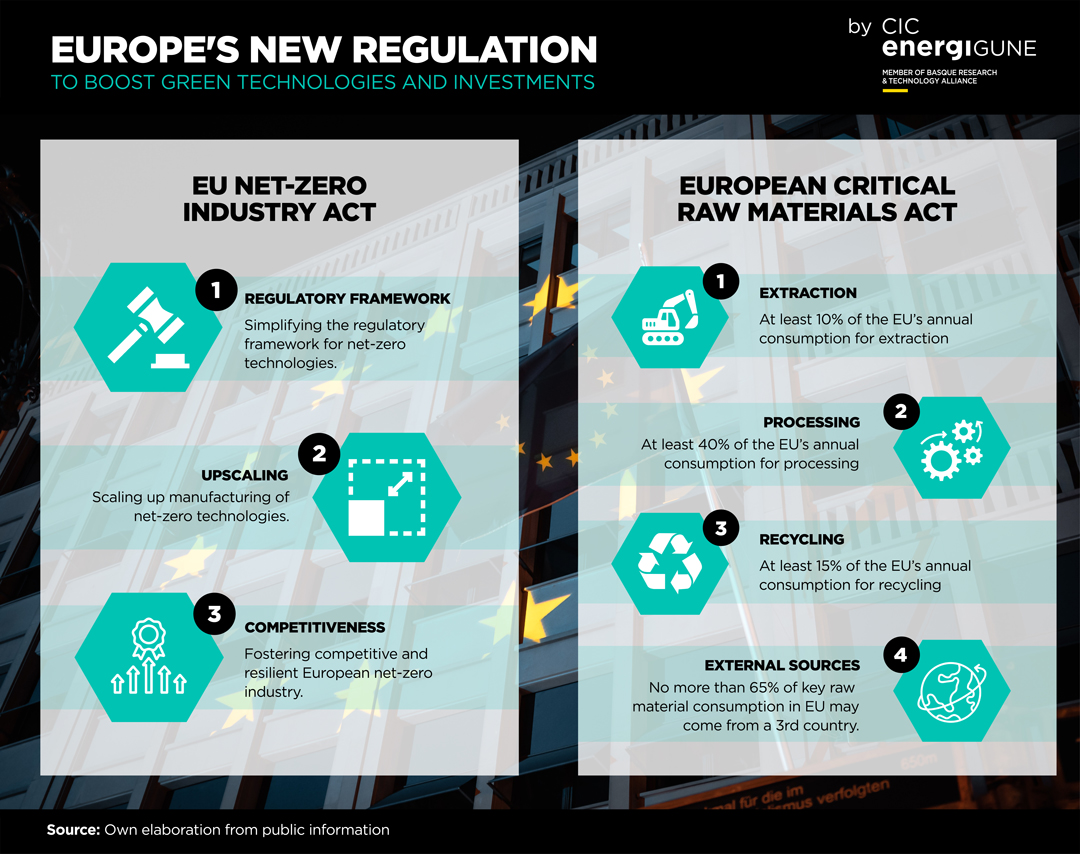

The "EU Net-Zero Industry Act" aims to ensure the deployment and competitiveness of technologies associated with decarbonization.

Specifically, the regulation itself identifies eight large blocks of strategic technologies that it prioritizes and seeks to promote through the content of its legislative body. These are: (i) solar photovoltaic and solar thermal; (ii) onshore wind energy and marine renewable energies; (iii) batteries and storage; (iv) heat pumps and geothermal energy; (v) electrolyzers and fuel cells; (vi) biogas/biomethane; (vii) carbon capture and storage; and (viii) grid technologies.

How is this impulse implemented? Through different initiatives defined and developed in the Law itself, which seek to respond to the demands that have long been raised by large investors and technology players to continue betting on Europe.

For example, one of the main "complaints" unanimously pointed out so far by these agents has been the complex bureaucracy associated with the development of projects, both in their preparation and awarding phases and in the subsequent stages of industrialization and commercialization. Through this new Law, the aim is to streamline all these processes, establishing simplified processes for the granting of permits and reducing to "one-stop shops" the management with public institutions. In addition, a "strategic project" categorization is established for those initiatives considered to be of high value in order to accelerate their development through even faster authorization procedures.

Beyond this simplified bureaucratic framework, the Law also establishes other strategic pillars aimed at making the green technology ecosystem in Europe even more attractive. One of the major novelties is the package of measures aimed at encouraging the development of projects in Europe, for which sustainability and resilience criteria are introduced in the tendering and public procurement procedures, in order to encourage demand (in this case, public) for new green solutions associated with the 8 technological blocks mentioned above.

Likewise, and in order to guarantee the viability of the projects, the EU foresees different training plans designed to ensure the qualification of the EU workforce according to the needs and challenges of the energy transition industry and its technologies. To this end, intensive collaboration and cooperation between countries is proposed in order to define training programs aimed at developing the required knowledge and skills.

In addition, the change also paves the way for promoting collaboration with third countries in line with the European energy transition strategy, especially in terms of investment in new technologies and, especially, in their commercialization (in order to guarantee a potential market larger than just the European one for companies that decide to operate from the continent). Regulatory "sandbox" systems are also established, designed for testing innovative solutions and technologies in a controlled manner, with special conditions and support for a limited period of time.

As we have seen, through the "EU Net-Zero Industry Act", the EU aims to put in place a package of "facilities" and incentives that will awaken the interest of investors in new projects and initiatives. However, the Commission is aware that none of this will be enough if the sustainability, independence and competitiveness of the region with respect to third countries and "rival" continents in this race is not ensured. In this sense, one of the key aspects to ensure this position is the guarantee of supply in key raw materials for the local production of new green technologies, something that Europe seeks to strengthen through the "European Critical Raw Materials Act".

Thus, this Act aims to ensure the secure and sustainable supply of critical raw materials to the EU, strengthening all key activities in its value chain. In addition, it establishes mechanisms aimed at diversifying the origin of the continent´s imports in order to reduce strategic dependence on third countries and mitigate the risks of interruption in the supply of critical raw materials. This includes, for example, packages of measures aimed at improving circularity and sustainability.

Based on these goals, we can group the actions contemplated in this regulation into four large blocks or regulatory pillars.

Firstly, it establishes and codifies what is considered critical and strategic raw material for the EU. Based on this, criteria are proposed for extraction, transformation and recycling capacities of critical raw materials in the EU and diversification efforts are oriented, setting targets for productive capacities according to the stage of the value chain:

On the other hand, new measures have been established to select and execute new strategic projects associated with the procurement of raw materials, speeding up the permitting process and improving the conditions for access to financing.

This regulation also sets standards to improve circularity and the efficient use of raw materials through mandatory measures aimed at ensuring that both operators and countries improve their resource recovery rates at the end of a product´s useful life.

Thirdly, policies are established to reduce potential supply risks, establishing control mechanisms for European supply chains and coordination between Member States and companies. In fact, it is envisaged that some large companies will be required to carry out audits of their supply chains in order to ensure a sufficient level of resilience in the event of a potential eventuality.

Finally, it establishes the creation of a Council composed of the Member States and the Commission to advise and coordinate the implementation of the aforementioned measures, as well as to identify and discuss potential strategic partnerships between the EU and third countries.

The answer to both questions will probably be known in the coming months, if not weeks. The ambition of both plans and their objectives is undeniable, and Europe´s commitment and effort to become the future benchmark for green technologies seems clear.

However, the raw battle that is taking place in recent weeks between continents and countries still demands to see how other parts of the world (USA and Asia especially) respond to these EU moves and, above all, how it is received by large companies interested in technological development and investment (especially those with potential markets beyond Europe). On their response and actions depends the green future of Europe and, who knows, the launching of new packages of measures and incentives.

Therefore, if you want to know how the race to dominate one of the industries of the future continues, we invite you to follow our blog and social networks with new analysis and content on the implications of this new EU strategy and how it is impacting both the European ecosystem itself and its "competitors".

Iñigo Careaga: Business analyst at CIC energiGUNE.

If you want to know the latest trends in energy storage and new developments in research, subscribe.

If you want to join a top-level team, collaborate with specialists in multiple disciplines or tell us about your concerns, don't think twice...