However, in parallel to all of them, there is also another key competition to determine the future big players in the sector, such as the fight for incentives and "facilities" that different governments and institutions are developing.

The objective of these incentives is clear: to attract all those investments associated with the development of key green energy industries. Therefore, different state and community governments are setting in their roadmaps different attractions and regulations with which to establish the best frameworks in order to convince investors and large companies to develop their ambitious plans in their territories.

These institutional movements have been going on for years (both in relation to these and other industries). However, it has been the great interest shown in recent months, which has put the focus on these plans and their prominence, in the face of industrial development in the coming years of sectors such as batteries or hydrogen, to give two examples. Especially in view of the announcements of some countries, such as the USA, which are seeking to give a definitive boost to their candidatures as hubs of reference in the future.

IRA: THE PLAN WITH WHICH THE US WANTS TO LEAVE EVERYONE BEHIND

As we saw in the case of the gigafactories industry, the US (and with them, North America) began to take positions in the battle to lead the energy transition later than other continents such as Asia or Europe. However, since the entry of the Biden Administration in January 2021, the country´s efforts have been focused on accelerating this commitment, trying to develop its own model based on its capabilities, its local companies and different public aid.

In this context, plans have emerged such as, for example, the boost to the electric car industry launched since the beginning of his term in office by President Biden, with a planned investment of more than 175 billion dollars over the next few years to accelerate the sector´s capabilities, as well as to promote its purchase among drivers.

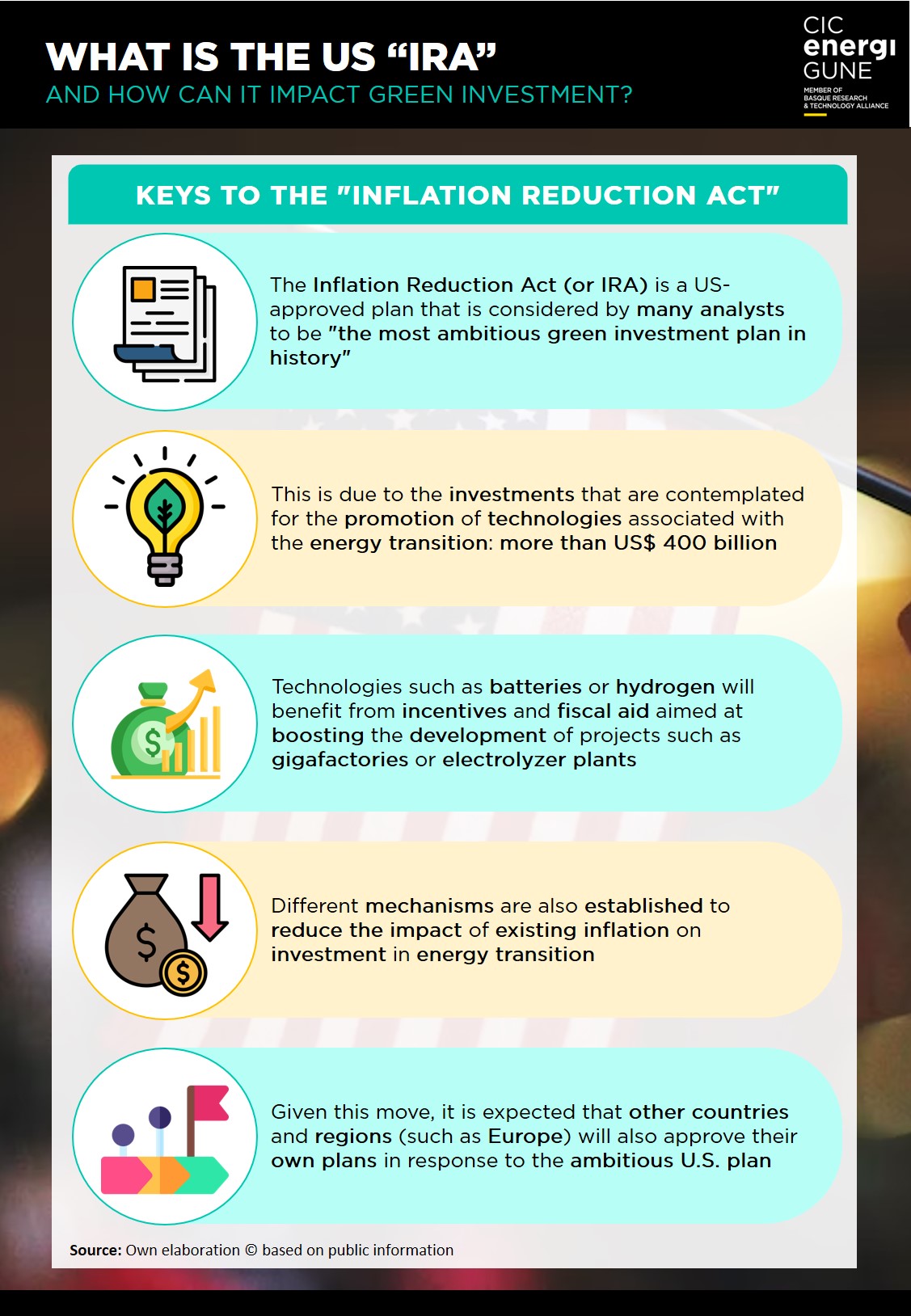

Despite this, the existing competition between regions has led the US to go one step further and strike a strong blow in the fight to attract the attention of investors and companies. Hence, at the end of 2022, it approved what is considered to be the most ambitious plan to date in this regard: the Inflation Reduction Act (or IRA, by which it is mostly known).

This plan contemplates (among other measures) more than 400 billion dollars in new investments throughout the country, with a special focus on industries related to green energy and the reduction of polluting gas emissions. For example, in the case of the production of cells and batteries alone, aid and credits for more than 30.6 billion dollars are expected by 2031, through an incentive model that will take into account the kilowatt/hour per year manufactured by those companies that decide to establish themselves in the North American country.

Similarly, support is also planned for other key technologies such as green hydrogen, with similar financing and support models, which will vary according to the final capacity installed on U.S. soil.

In addition to these financing and tax credits, there are other formulas for the promotion of renewable energies, which seek to broaden the financing options for potential projects to be developed in the USA, thus boosting their attractiveness in terms of economic-financial viability and profitability. It also establishes different mechanisms to reduce the impact of inflation on investment in the energy transition. All of this is financed through new taxes and collection systems such as a special 15% levy aimed at companies earning more than one billion dollars.

In this way, and due to its content, the "IRA" has come to be considered one of the most important measures in the history of investment and promotion of clean energies worldwide. Such is its ambition that other countries have also begun to move towards a response to a new regulation that could turn the current "green" industrial panorama upside down.