Carlos Tavares, CEO of the Stellantis Group, was the last to highlight his concern regarding critical materials, warning that this potential shortage could be a major problem in 2025 when the exponential growth in demand is expected to begin. Indeed, he predicts international conflicts over the control of these rare lands, which could lead to a similar scenario to that which, so far, has been experienced for other energy sources such as oil.

As a result, there are companies that, given these expectations, are starting to consider the possibility of including the extraction processes in their own battery production value chains. An example of this is Tesla, whose well-known CEO Elon Musk has already announced that they are working on the possibility of extracting their own materials from their own mines (such as the one they run in Nevada, USA).

It is worth remembering (as we have seen in previous posts in our blog) that raw materials represent about 65% of the final cost of a battery. This explains the importance of ensuring their access and availability by the major brands, to offer competitive products not only in technological terms but also in price.

However, the current outlook is not optimistic on this last point. A recent study made by E Source predicts that, given the expected "tsunami" associated with electric vehicles in the years ahead, it will not be possible to match this demand with the available supply due to the expected shortage of raw materials. This will imply, in economic terms, a 22% higher cost for each vehicle than initially estimated.

Two are the main factors that determine this situation. One of them is associated with extraction capacities: many of the large existing deposits still require the necessary means and resources to obtain them, which reduces, for now, the availability of supply.

This lack of infrastructure is mainly a consequence of the high cost that usually comes with the investments associated with mining. However, given the expected demand in the next years, it is fair to believe that more and more companies will invest in the development of these facilities, attracted by the economic potential of the market and its profitability.

However, the major challenge within the industry goes beyond the development of these extraction capabilities. As mentioned before, there is a very important geopolitical component derived from the concentration of these materials in the domain of only a few countries, which means that their access and control depend on a limited number of States. This explains the similarity with the current oil market, whose price and availability often depend on geostrategic variables, international policies, and trade wars.

That is why, to control this market, large countries with reserves within their borders have begun to invest urgently in the development of supply value chains that allow them to take advantage of the "wealth" available in their territories.

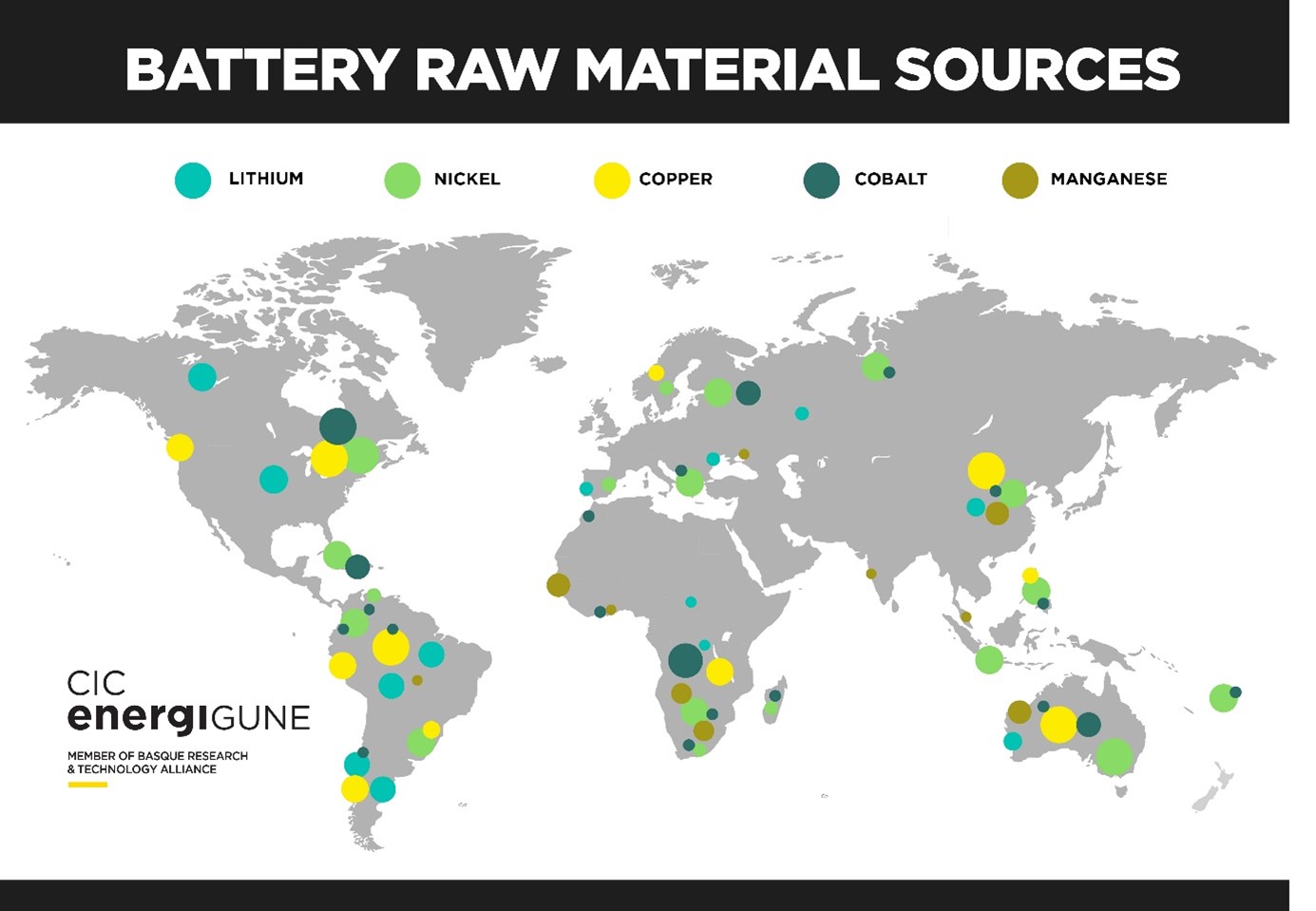

An example of this is China, which has significant concentrations of Lithium, Cobalt, Copper, Nickel, and Manganese. This allows the country to lead again this race in the battery industry, being currently the leading country in the mining industry for raw materials for the battery sector. To prove it, here is a shattering fact: only in 2019, China extracted and refined between 50% and 70% of all the lithium and cobalt obtained worldwide, as well as more than 35% of the nickel. Playing a very active role in all this development are China´s electric automotive giants, who are carrying out major investments and agreements with mining companies to ensure their upstream integration into the industry´s value chain.

Behind China, other big countries like Canada, Australia, or Brazil want to take advantage of their vast reserves of raw materials to strengthen their position as economic and industrial giants. At the same time, African countries such as Congo (which holds more than half of the world´s cobalt reserves), Angola or Botswana, or South American countries such as Peru, Chile, or Argentina, see it as an opportunity to accelerate their growth and increase their wealth.

Whatever the reasons, what is clear is that there is fierce competition for dominating a very limited market, as can be seen in the following graph:

It is worth noting that this dispute is bringing with it other debates that are not trivial. On the one hand, sustainability and environmental impact of the massive extraction of these resources, as they often lead to land degradation and erosion, as well as emissions of polluting gases and greenhouse gases. On the other hand, abuse and human exploitation situations which have already been reported by different organizations when obtaining these resources, and which have led to the use of the term "blood minerals" to refer to the extraction process.

In this situation, those regions and countries with a high dependence on third-party resources are already working on achieving what could be called "technological independence". Unable to control supply, they seek to depend as little as possible on other producers through new technological routes that allow them to optimize and promote the "circularity" of the sector.

This is the case, for example, of Europe, which has begun to play its cards in this regard. This is why the continent is giving great importance to developing other capabilities within the battery industry, such as second life and battery recycling.

Moreover, the use of new technological solutions such as machine learning or artificial intelligence in the production and recycling processes is playing an increasingly important role, to take advantage of their potential to ensure process optimization and reduce material waste as much as possible.

All of this is aimed at optimizing the use of key raw materials within the industry, either to avoid greater dependence on third parties or to ensure the sustainability of one of the key sectors for energetic transition.

Agents like CIC energiGUNE play a key role in the European battery ecosystem, thanks to their lines of research and work on the second life, recycling, and optimization of production processes.

Author: Iñigo Careaga, Business Analyst at CIC energiGUNE.

If you want to know the latest trends in energy storage and new developments in research, subscribe.

If you want to join a top-level team, collaborate with specialists in multiple disciplines or tell us about your concerns, don't think twice...