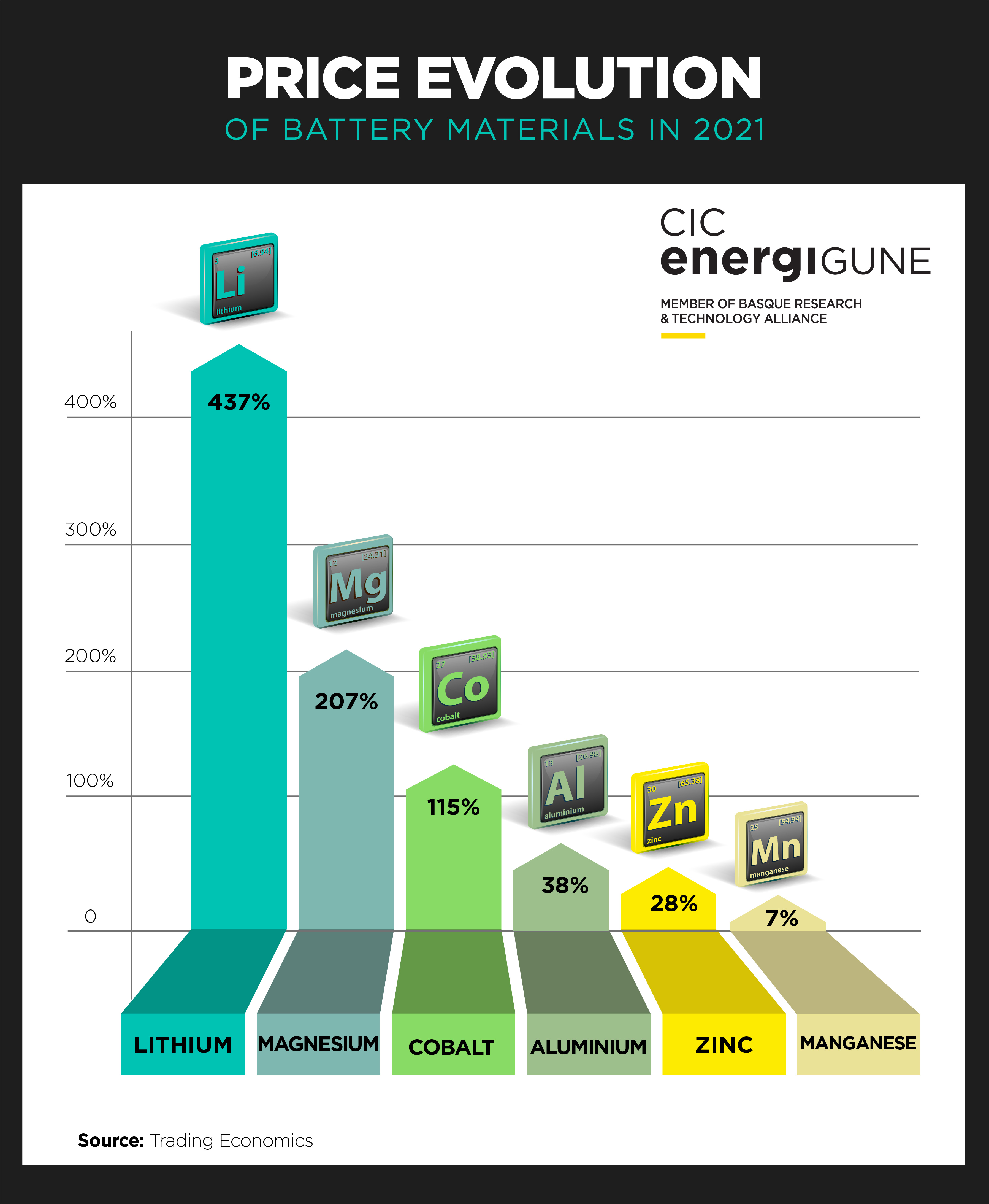

One of the materials that has been suffering most from this increase in price in recent months is lithium, due to its use in both current and future generations of batteries, as it is included in different battery elements such as the electrolyte or the anode. Hence, in 2021, for the first time, the global demand for lithium will exceed the supply. In fact, this explains why the price of lithium carbonate transported by sea rose 437% last year, according to data from Trading Economics.

But why is lithium such a key commodity?

There are three main reasons:

- It is a highly reactive material, easily detaching from its outermost electron. This makes it easier for current to flow through the battery so that it can function properly.

- Its light weight gives it a competitive advantage over other materials that can potentially be used in batteries, such as lead. This makes lithium-based batteries a more attractive option for subsequent applications such as consumer electronics or electric cars.

- They have a high recharge capacity, as lithium ions and electrons are able to easily return to the negative electrodes.

However, there are not all advantages when analyzing the use of this material. Due to their nature, batteries containing lithium have a certain instability, which makes them more sensitive to extreme temperatures and somewhat less safe in the event of an accident. Hence, these types of batteries are often equipped with BTMS controllers to manage and control the temperature and its possible flammability, keeping the battery operating temperature in the optimum operational range in terms of efficiency and stability (between 15 and 40 ºC) regardless of the external environmental conditions.

It should also be taken into account that, being a moderately abundant material in the earth´s crust, it is concentrated in specific areas of the world, which complicates its access and use for those countries that do not have their own resources. As a result, as mentioned above, its price is rising due to the high speculative component of this material by the countries that dominate its supply.

Along with lithium, another key element in the development of batteries is graphite. This mineral, which is usually used synthetically in the anode, allows the intercalation of a large number of lithium ions in its structure, and also shows low ionization potentials compared to lithium. This makes it compatible with traditional cathodes and electrolytes, increasing the charging voltage of batteries up to 4.2V.

Such is its significance (at least in the current generations of batteries) that there are starting to be worrying forecasts as to whether it will be possible to meet all the expected demand for this resource. According to a study by Benchmark Mineral Intelligence, by 2022 there will be a shortfall of around 20,000 tons of graphite worldwide, which is causing large companies to look for alternatives and solutions to guarantee the supply of this material. Even more so, if we take into account that today, around 70% of all graphite worldwide comes from China, with the consequent "instability" that this may entail in the supply chain.

Cobalt begins to lose prominence to other alternatives and compositions for cathodes

Along with lithium, another major material that has seen its price rise (in this case, doubling) has been cobalt. This metal, used mainly as an active material in the cathode, has been one of the main resources used in batteries as it is a material that increases battery life and energy density thanks to the stability it provides to the battery structure while it is being charged and discharged.

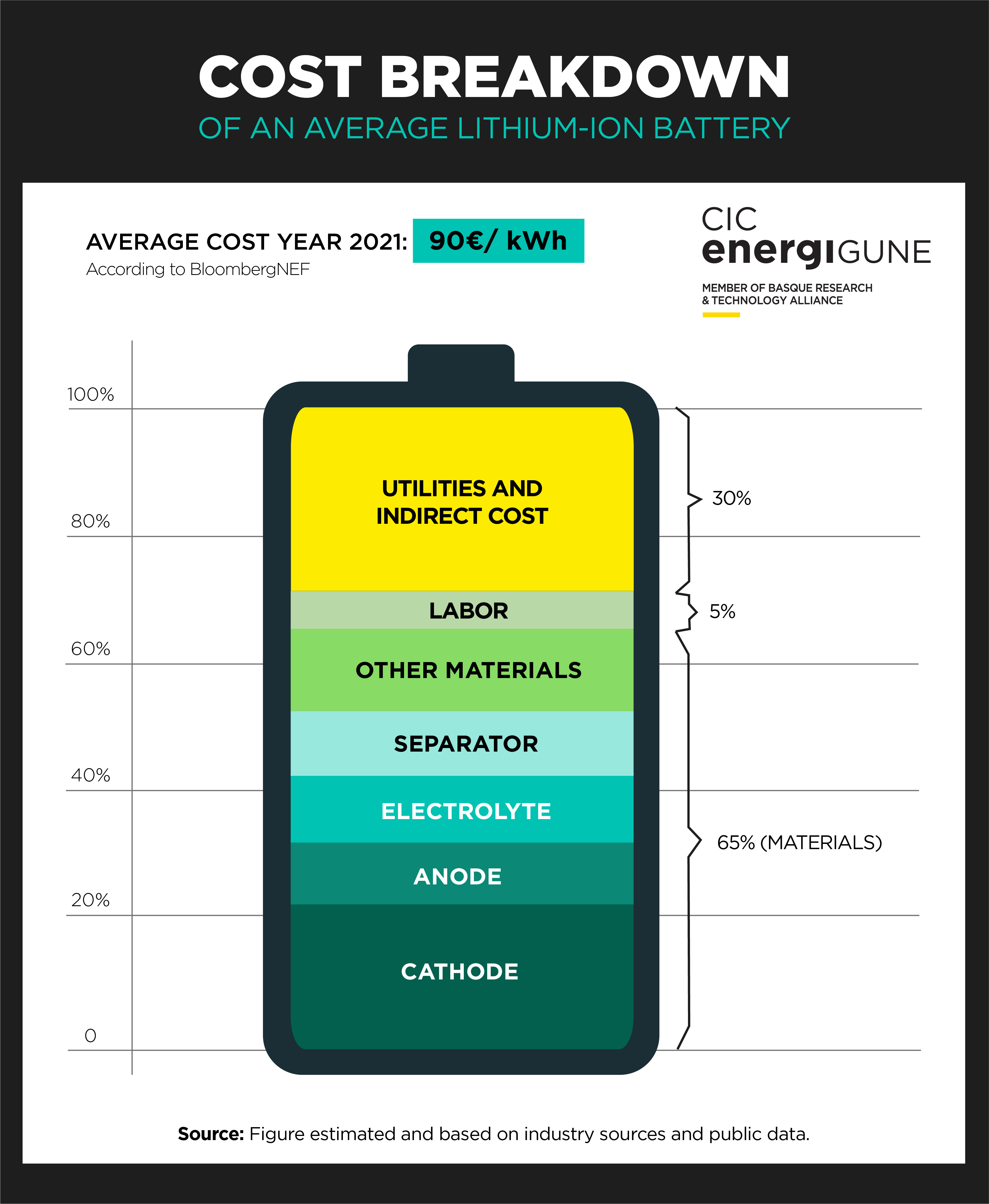

However, its use in the industry seems to have the days numbered due to two main reasons. On the one hand, cobalt (which is usually extracted as a by-product of nickel and copper mining) is a traditionally expensive material. According to BloombergNEF, the use of this material currently represents 30% of the total cost of the battery. On the other hand, its extraction is mainly concentrated in the Republic of Congo (more than 70% of the world production came from this country in 2019), in work and human conditions denounced by large international organizations that are causing many industry players to try to reduce their dependence on this material and collaborate with the authorities of that country.

For all these reasons, major companies in the sector such as Tesla, Samsung or Panasonic are already working on the development of parallel battery technologies that reduce or even eliminate the use of this material in their batteries. This is demonstrated, for example, in Tesla´s commitment to the development of batteries with LFP cathodes, despite the limitations that this may entail in terms of performance, largely compensated by their lower cost, greater cyclability and lower social and environmental impact.

In the same line, CIC energiGUNE is working on the development of a new generation of cobalt-free lithium-ion batteries through the CoFBAT project. This involves research into high-voltage, high-capacity active materials to produce a cobalt-free cathode which, together with a novel gel electrolyte, will make it possible to obtain high-density batteries with an extra-long life cycle and reduced costs.

Another material traditionally used by industry is nickel, especially since the 1990s. Its use is due to the fact that it helps to achieve higher energy and storage density without being a particularly expensive element (although its cost, as in the previous cases, has risen steeply in recent months).

This explains its success and the bet that large manufacturers and automotive companies are making on cathodes containing this material in both current and future generations of batteries, such as NCM (Nickel-Cobalt-Manganese Cobalt) or NCA (Nickel-Cobalt-Aluminum). Moreover, the usual proportion of nickel in these compositions is gradually increasing, because of its properties as well as the industry´s interest in reducing other elements such as the aforementioned Cobalt.

Along with them, manganese is another of the most widely used and exploited materials in the industry. Once again, we are talking about a resource mainly used in cathode compositions, where its application in small quantities improves the electrochemical performance of batteries, especially in terms of energy density and safety. It is therefore found, for example, in the NCM cathode compositions mentioned above together with cobalt and nickel and is one of the materials that is expected to continue to be part of the battery compositions of the future, also with lithium iron phosphate -LMFP-.

Following the cathode compositions that seem to have the greatest potential in future generations of batteries, we find aluminum, the third component of the NCA formula. Again, its use in cathodes, in particular, has been shown to increase battery properties and performance, especially in terms of energy density.

It is also the most abundant metallic element in the earth´s crust, second only to oxygen and silicon (both nonmetals). This is another added advantage for the expansion of its use in industry, due to its lower associated cost. Hence, it is also beginning to increase its proportion in compositions such as NCA cathodes to the detriment of cobalt.

In addition, there are technological proposals that, due to their properties and abundance, even propose using aluminum ions as the basis for the development of new generations of batteries in the future.

Finally, another of the elements that has been gaining prominence in recent months is silicon. This material, even more abundant than aluminum, is being evaluated in different research projects as an alternative to graphite with a view to being included in the anodes of future generations of batteries. For the time being, the results are promising, achieving a higher energy storage capacity.

Potential new technologies and theri associated materials

As with aluminum, the emergence of new technological routes that seek to replace lithium as the "base" of the chemical composition of batteries is also causing an increase in demand for other materials.

This is the case, for example, of sodium batteries, thanks to the popularity that sodium ion-based solutions have been gaining in recent months. Mainly due to the interest and development that the large manufacturer CATL has triggered by announcing its intention to start industrializing this technology on a large scale from 2023.

In this same sense, the development of other research lines based on calcium, zinc or magnesium also open the door to these resources becoming key supplies for industry and device manufacturing in the future.

In other cases, the demand for materials is concentrated on elements intended to "accompany" lithium, as occurs, for example, in lithium-sulfur batteries. This solution, which combines a lithium anode with a sulfur cathode, stands out for its high gravimetric energy density thanks to the high theoretical capacity of the active material, its low cost and its wide availability/abundance.

Thus, as can be seen, the emergence of the industry and the range of technological alternatives that it presents today pose a future scenario in which different raw materials will be involved. Hence the importance of guaranteeing their supply, something that in many cases presents risks, generally due to international political reasons and trade relations between countries.

For this reason, the different countries and companies involved in the war to lead this industry are trying to ensure access and supply of these raw materials, especially thanks to major agreements or the exploitation of their own natural resources. Even more if we take into account market trends, where, as we can see in the following chart, the price for some of these key materials has been rising steadily in recent years: