The main goal is to overcome the potential challenges that an excess demand could cause in the supply chain. In this way, the aim is to complement current technologies with new solutions that can provide a similar response to lithium batteries, thus reducing dependence on this material.

But at the same time, some large manufacturers are also beginning to see the possibility that some of these bets could take batteries to a new scenario, surpassing the current performance of conventional lithium-ion technologies as well as the challenges presented by their manufacturing process (especially related to obtaining raw materials).

To this end, announcements and developments are beginning to emerge that combine new materials with lithium or even replace it entirely.

Sodium begins to gain popularity

In this context, one of the most popular potential alternatives in recent months has been sodium-ion batteries, especially after the announcement of the giant CATL (Tesla´s primary battery supplier). Last July, the Chinese company presented the first generation of sodium-ion batteries, announcing its intention to start industrializing this technology on a large scale from 2023, combining it with the lithium-based solutions and designed to be used in mobility applications and, above all, stationary applications.

As great strengths, sodium-ion batteries present fast-charging capacity, lower cost and greater sustainability, key features for uses such as electric vehicles or the electric grid. However, there are still two major areas for improvement in which work will continue in the coming years. Especially the energy density, which means a lower autonomy of these batteries compared to lithium-ion batteries. Thus, while, on average, a lithium-ion battery can have an energy density of around 250 Wh/kg on average, the current state of the art of sodium-ion batteries places this indicator at around 150-160 Wh/kg.

CATL itself has already announced that the second generation of sodium-ion batteries will have a density of around 200 Wh/kg, which shows that there is still room for improvement in this regard.

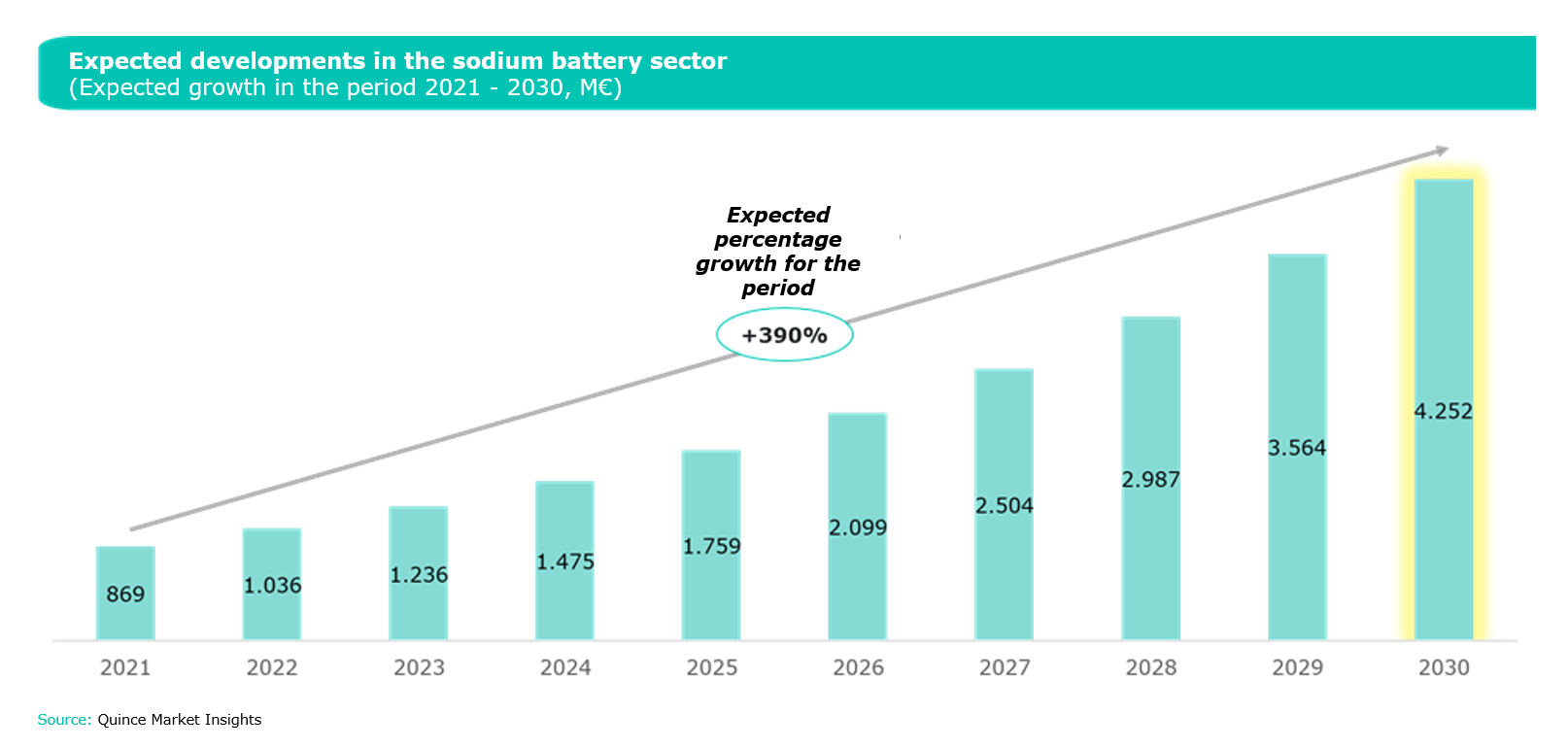

This alternative is not new in the market, as entities such as Faradion, Natron Energy, Tiamat or CIC energiGUNE itself have been working with it for years due to its potential. But CATL´s announcement indeed demonstrates the commitment that the industry can begin to make to this technology. Hence, some experts see it as a strong candidate to complement or even partially replace lithium-ion batteries. It is expected that by 2030, the value of the sodium-ion battery market could exceed 4 billion euros worldwide: