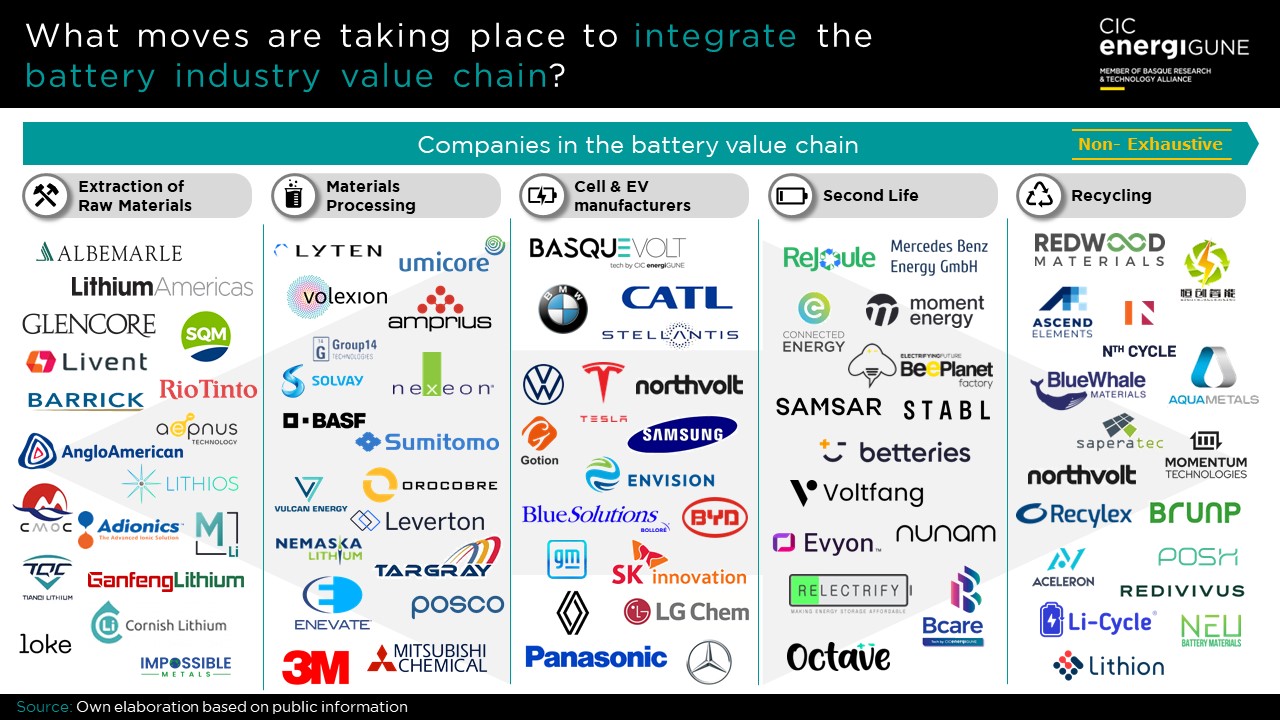

The reason for these moves is clear, especially with regard to the initial stages (such as material extraction or processing): to ensure the entire value chain and its deployment now that the industry is still in an incipient state and with some phases of activity "limited" (such as supply itself, due to the potential shortage of raw materials in the coming years).

Thus, through these operations, large companies that want to dominate the market (whether they are battery or vehicle manufacturers - the latter being the major market drivers) seek to ensure their control and competitiveness along the entire value chain and its key stages. This includes not only the "upstream" activities or those prior to cell manufacturing, such as those already mentioned, associated with obtaining raw materials and their treatment (which, in the short term, are perhaps the highest priority in order to guarantee the development of the industry).

Likewise, the interest of these companies is also focusing on ensuring key activities for the future of the industry in the medium term, such as the second life of devices or their recycling. All this, with the aim of ensuring a complete "circularity" in the long term that will provide a real competitive advantage in order to dominate one of the major industries of the future.

SECURING SUPPLY, THE TOP PRIORITY IN THE SHORT TERM

In this context, the major announcements that are taking place in recent months are mostly focused on the development of large agreements and investments associated with the extraction of raw materials and their processing. As we already saw in our analyses in social media, it is expected that by 2030 there will be a notable shortage in critical materials for the industry (such as lithium, cobalt, nickel or copper).

For example, in the case of lithium alone, demand growth is expected by 2030 to ≈1.85 Mt (including both its use for batteries and other applications). In contrast, taking into account ongoing projects and current capacities, production (and thus supply) will "only" increase to ≈1.4 Mt.

This explains the "race" that is taking place to ensure the supply and control over these resources, which are essential to establish a truly competitive and profitable activity around batteries.

In this regard, it is the large automotive OEMs that are making the most ambitious moves. Above all, those that have internalized or secured the supply of cells through their own activities or agreements with specialized manufacturers. Their aim with these operations is to integrate the value chain even further upstream and secure the supply flow from the start.

A clear example of this is the US giant GM, which recently announced its investment of more than 650 million dollars in the world´s third largest lithium mine (located in Nevada, USA). With this agreement (made together with the company Lithium Americas Corp.), the vehicle manufacturer also ensures that it will be the only customer of the mine, with the aim of guaranteeing its supply while reinforcing its competitiveness with respect to other producers.

However, this is just one of many announcements made in recent months by major players in the automotive and battery manufacturing market. Similar to GM, companies such as BMW (which has invested in Argentine mines); CATL (which, together with its partner CMOC, will operate mines in Bolivia); or Tesla (which has already announced its intention to operate the mines it has acquired as property in 2020, also in Nevada) have made moves to integrate extraction activities into their operational scope.

To these operations are added strategic agreements with companies specialized in the sector for the supply of raw materials (such as, for example, Tesla´s own agreement with Piedmont Lithium) in order to complement its own supply capabilities.

However, the integration of raw material extraction is only part of a larger scope that some companies are adopting. A clear case in point is Stellantis, which is betting on a broader strategy that not only includes securing the supply of materials (thanks to its entry into the capital of companies such as Vulcan Energy), but also their processing for subsequent use in batteries. Hence its investments and supply agreements with companies such as Australia´s Element 25 and Finland´s Terrafame, which will ensure the supply of manganese sulfate and nickel sulfate respectively for the coming years. Here again, GM has made progress in different collaboration and joint investment agreements with materials companies such as LG Chem and Livent.

But it is not only the big car manufacturers that are moving in this direction. The main cell producers also stand out, such as SK On (which has reached a joint collaboration agreement to process graphite together with Urbix Inc. for its US gigafactories) or Panasonic (which has secured the manufacture of cathode materials for its plants also located in the USA through Redwood Materials).