As we have already mentioned on previous occasions in our blog, the European Union is one of the regions in the world that is making a greater investment in the battery factory industry. Especially because it is expected to achieve both economic and environmental objectives, something that is aligned with the post-covid recovery plans defined at EU level since the pandemic of 2020.

Now, this industrialization plan for the battery sector at European level has been several years in the making. Already in 2017, European Commissioner Maroš Šefčovič announced the continent´s intention to develop the battery sector as a key lever for its future competitiveness, investing, for this purpose, in initiatives that would allow Europe to gain a certain technological independence from other countries (such as China, the current major market leader).

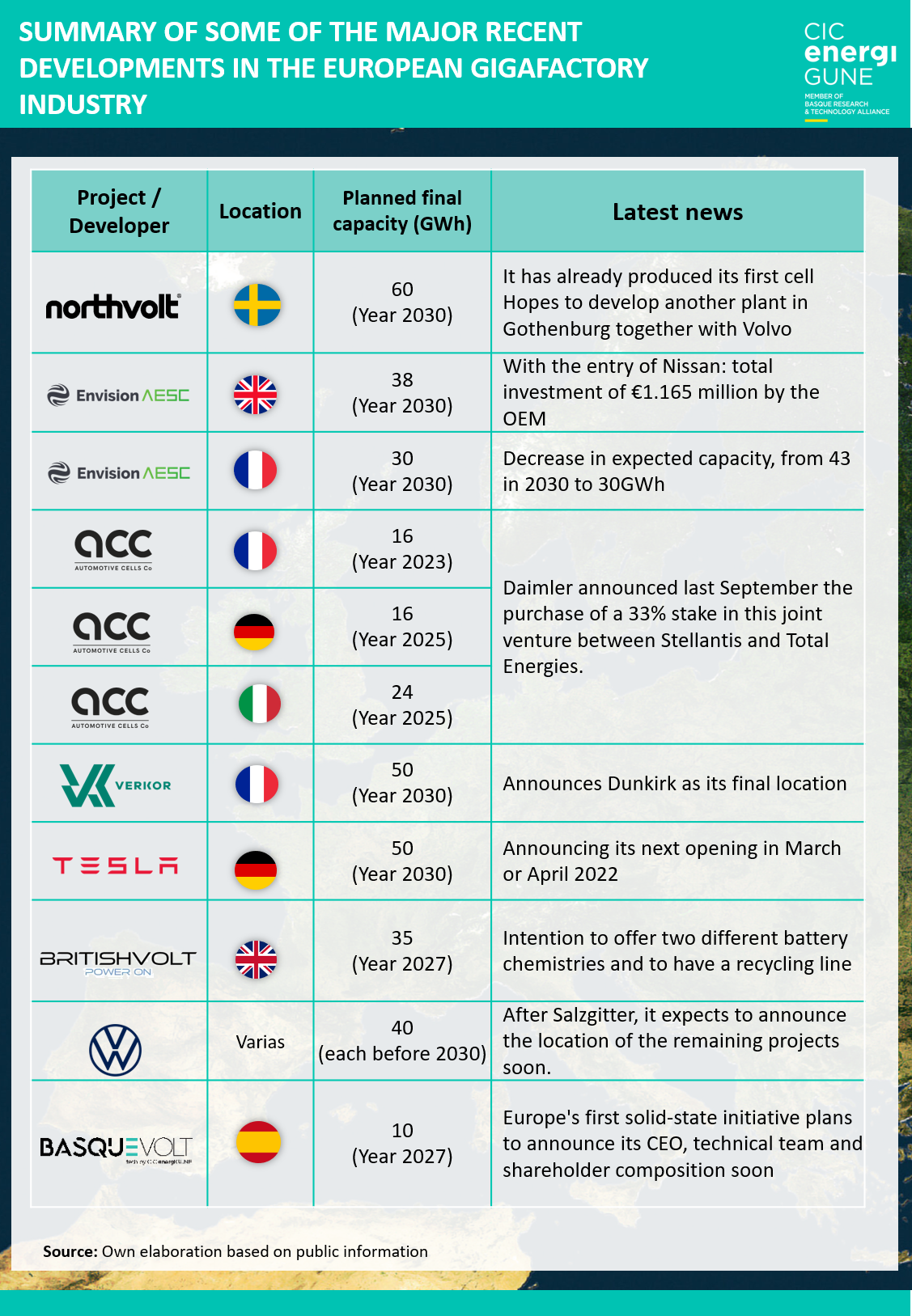

This context gave rise to one of the main initiatives that is currently being developed in Europe: Sweden´s Northvolt. Led by two former Tesla executives, this company is one of the projects in which the European industry has high hopes for its development.

Not surprisingly, last December Northvolt became the first European gigafactory to start assembling its own battery cell technology in Europe, thus kick-starting its factory in northern Sweden that expects to reach a capacity of 32 GWh per year. In addition to this, the company is reaching agreements with large OEMs in the automotive sector with the intention of developing new projects, such as the recently announced agreement with Volvo (whereby they expect, from 2025, to have a new gigafactory in Gothenburg with the capacity to equip 500,000 electric cars per year).

This opening is expected to be joined shortly by Tesla´s large gigafactory project in Berlin. According to the latest news, it is expected that before the end of the first quarter of 2022, the company led by Elon Musk will start operations at its plant -on the outskirts of the German capital-, which expects to reach a production capacity of 40 GWh per year according to the most conservative estimates.

Large OEMS gain prominence on the project map

Indeed, it is precisely the major automakers such as those mentioned above that in recent months have concentrated some of the main developments in terms of projects and investments.

Above all, perhaps the most outstanding case is Volkswagen, which in March 2021 announced its intention to open up to 6 gigafactories by 2030 across the continent. One of them already has a location and development (in Salzgitter, Germany) and more details of the other locations and projects are expected to be known during the first half of 2022.

Another company that has accelerated its plans for the industry is Stellantis. Last year, the group announced the start-up of its third gigafactory project, in this case in southern Italy (in the city of Termoli). This initiative joins the other two already under development through ACC, which are the result of the joint venture with Total Energies and are located in Billy Berclau Douvrin (northern France) and Kaiserslautern (western Germany).

ACC has also made headlines in recent months thanks to the investment in this initiative, together with Stellantis and Total Energies, by another major OEM: the German giant Mercedes Benz, which announced last September the acquisition of a 33% stake in ACC.

Not far from the ACC plant in Douvrin will be located another major project with an important OEM in its midst: the one developed by the French startup Verkor together with Renault in the city of Dunkirk, in northern France. Last summer, the French carmaker announced its intention to invest in this project in order to begin to implement its electrification strategy for the coming years. In fact, it is not the only project in which it will participate, as it also announced the project with Envision AESC that it is developing in the city of Douai, also in northern France.

Their collaboration pattern will be similar to the one that Envision itself is already carrying out with Nissan for the implementation of a gigafactory of up to 38 GWh in Sunderland (UK). This project, together with Britishvolt, which is already under construction (in collaboration with Lotus Cars, among others), aims to position the United Kingdom as one of the main battery production hubs in Europe.

Another country aspiring to lead the industry is Italy, especially thanks to the aforementioned Stellantis project and the Italvolt macro-project (the largest of those planned in Europe, with an expected capacity of 70 GWh). The latter, which will be located in the north of the country, has recently been reported to be in the design phase, with the aim of starting up the plant in 2024 with a "fully sustainable" model.

Spain accelerates its commitment

One of the countries that presents the greatest number of innovations in recent months has been Spain, the second largest automobile manufacturing country in the European Union.

Due to the importance of this sector in the country, different initiatives have been taking shape or emerging in recent months with the aim of meeting the demand expected in Spain and the rest of Europe in the coming years.

In this sense, the aforementioned Volkswagen has announced its intention to set up one of its six gigafactories in Spain. In fact, the German brand is currently working on selecting the final location for this project, with which it expects to reach a production capacity of 40 GWh once it is fully operational.

The Basquevolt project, the spin-off of CIC energiGUNE, located in Vitoria-Gasteiz (Basque Country), is another of the major initiatives underway. Above all, due to its technological proposal, as it is the only project currently under development in Europe focused on the future generation of solid-state batteries (the big bet of vehicle manufacturers in the medium and long term). Commissioner Maroš Šefčovič himself has highlighted this fact, stressing that "Basque battery technology is extremely valuable for Europe".

All this, while waiting for the new aid plan that the Government has announced for this year, charged to European funds and expecting to boost the electric and connected vehicle industry.