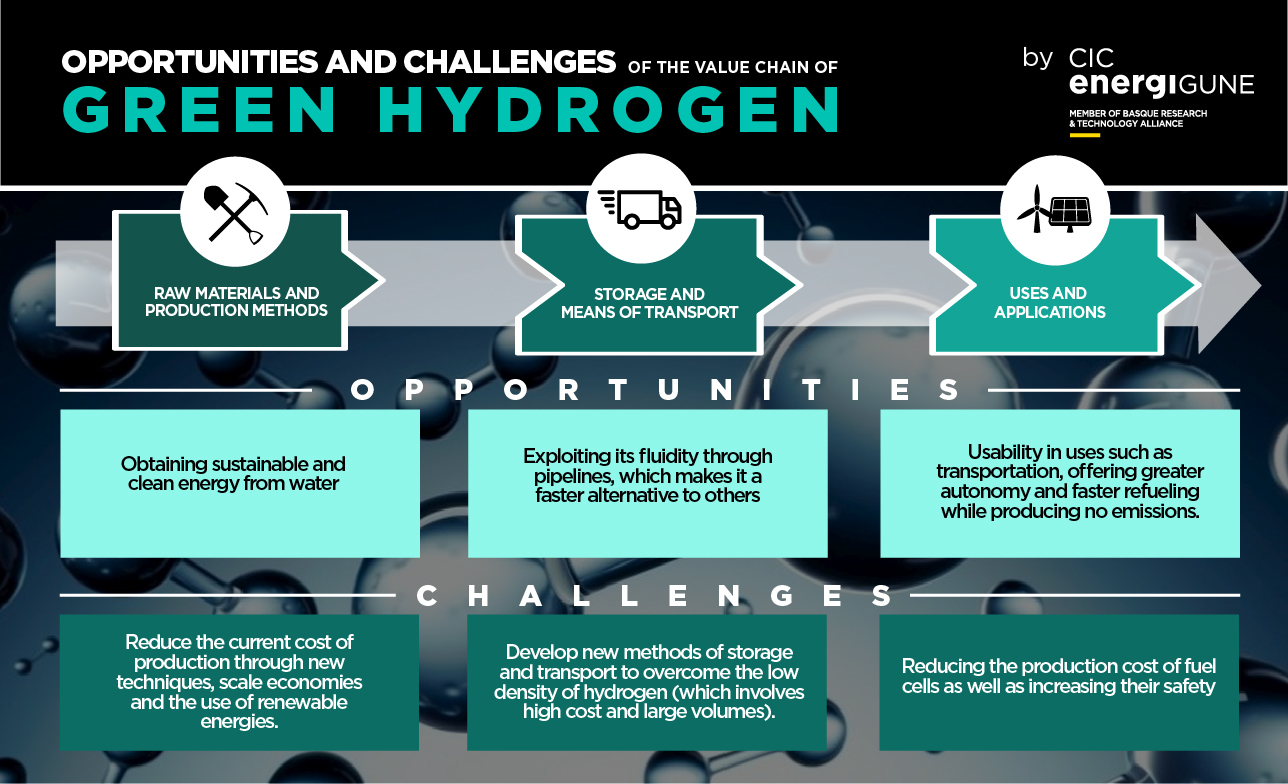

However, much of this investment is aimed specifically at ensuring that hydrogen can be a real alternative. Despite its theoretical advantages and potential, it is an industry that still presents, apart from many opportunities, great challenges along the different stages that make up its value chain.

Boosting renewables will accelerate hydrogen production

As explained in previous blog posts, electrolysis is currently the most sustainable and developed production method for obtaining hydrogen. It is also the system that allows to obtain the highest H2 purity (almost 100%), which makes it highly valuable as it offers better results to be exploited later on. All this, with zero impact on the environment, since it is a non-toxic process for its environment.

Currently, there are three different categories or routes that are being developed to boost hydrogen production through electrolysis.

These routes, from most to least developed, are alkaline electrolysis (AWE), Proton Exchange Membrane electrolysis (PEM) and high temperature solid oxide electrolysis (SOEC).

Although each has its own strengths and areas of improvement, what they do have in common is the great challenge facing the industry today: the need to reduce the current production cost of obtaining hydrogen by any of these three routes.

According to estimates by the US Department of Energy, the cost of hydrogen production should be less than 2 dollars per kilogram (almost 1.8 euros) in order to be competitive in any of its applications.

However, this is a goal that still seems far off, if we go by the figures presented by the International Energy Agency in its 2019 report, where it is noted that no country or region has yet managed to reach this figure (which stands, according to the same report, at around 3 dollars). However, logic suggests that in the coming years this figure will begin to fall as the cost of renewable energies used for hydrogen production decreases, which will lead to a substantial reduction in the opex of these processes.

In addition, organizations that are supporting hydrogen, such as the International Renewable Energy Agency or the United Nations Organization itself, have defined different strategies to try to complement these forecasts with other ways of reducing this production cost. All of them seem to leverage this reduction -in addition to the use of cheaper renewables- on the development of scale economies, thus seeking to increase the level of production to large volumes that reduce the cost per kilogram produced.

As a result, platforms such as "Green Hydrogen Catapult" are beginning to emerge, constituting collaborative networks between companies such as Iberdrola, Yara or Envision with the aim of increasing current production levels and reducing the average cost.

These types of initiatives, together with the aforementioned reduction in the cost of energy sources, will be the main levers on which the gradual implementation of the electrolyzer industry will be based.

Likewise, there are other possible ways to reduce costs, such as improving the efficiency of the electrolysis process (thus reducing the energy losses) and adapting the generation technologies to the specific use or application in which the hydrogen obtained is to be used. All this with the aim of achieving an increasingly cheaper hydrogen, which is currently the main way to accelerate the energy transition in the coming years.

The need to develop storage and distribution infrastructures

Once hydrogen has been obtained, the next stages in the value chain are storage and distribution so that it can be used when and where desired.

Due to the low density of hydrogen, its storage requires large volumes and is associated with high pressures and low temperatures. This poses a challenge for both storage and transport infrastructures, as generally expensive and high-capacity methods are required.

For example, to make hydrogen as ubiquitous as natural gas is today, require a huge coordinated program of upgrading and building infrastructure and networks. This improvement would take advantage of, among other things, its fluidity, as hydrogen is capable of flowing almost three times faster than methane through pipelines, making it a cost-effective option for large-scale transportation.

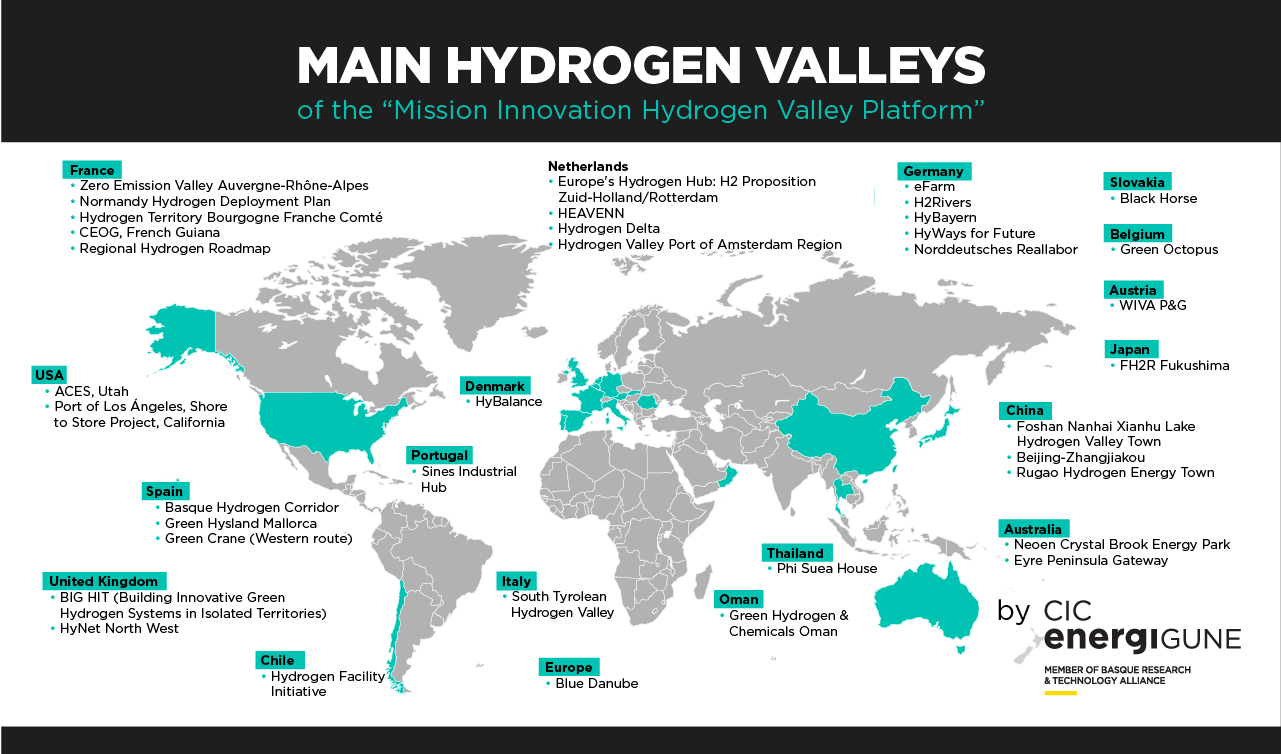

In this sense, initiatives such as the "European Hydrogen Backbone" are already working on the development of these systems, which would allow the gradual creation (as hydrogen becomes more popular in its production and use) of a backbone network of gas pipelines connecting the "hydrogen valleys" (centers of hydrogen supply and demand) with each other. According to various forecasts, these networks could reach a length of 6,800 km in 2030 and 23,000 km in 2040.

As these networks become integrated into the energy system, it is expected that this will offset the high cost of alternative transportation by road or ship.

Currently, this problem and the lack of infrastructure is causing some companies to come up with alternative models to reduce the impact of this issue. For example, it is a critical factor to be able to guarantee the development of refueling stations in the future for hydrogen-powered vehicles.

Companies such as Standard Hydrogen are working on refueling models where the station combines the hydrogen generation phase with subsequent refueling. To this end, they have partnered with the energy company National Grid, which will be responsible for managing these facilities and generation through a compact modular system that includes a stationary energy-generating cell. In return, the electric company will be able to use the energy generated in case of peak demand, with the aim of making the investment profitable in its first years of life and to be compatible with the growing demand for hydrogen-powered vehicles.

In any case, once again it can be seen how the development of scale economies, which guarantee volume, efficiency and profitability in the development of these infrastructures, play a key role in overcoming the challenges posed by this industry.

Hydrogen-based applications key to energy transition

Finally, we find the usage stage, where the aim is to take advantage of the benefits offered by hydrogen in applications such as stationary or in transport. Here is where the so-called "fuel cells" come into play, devices that allow chemical energy (hydrogen) to be transformed into electrical energy.

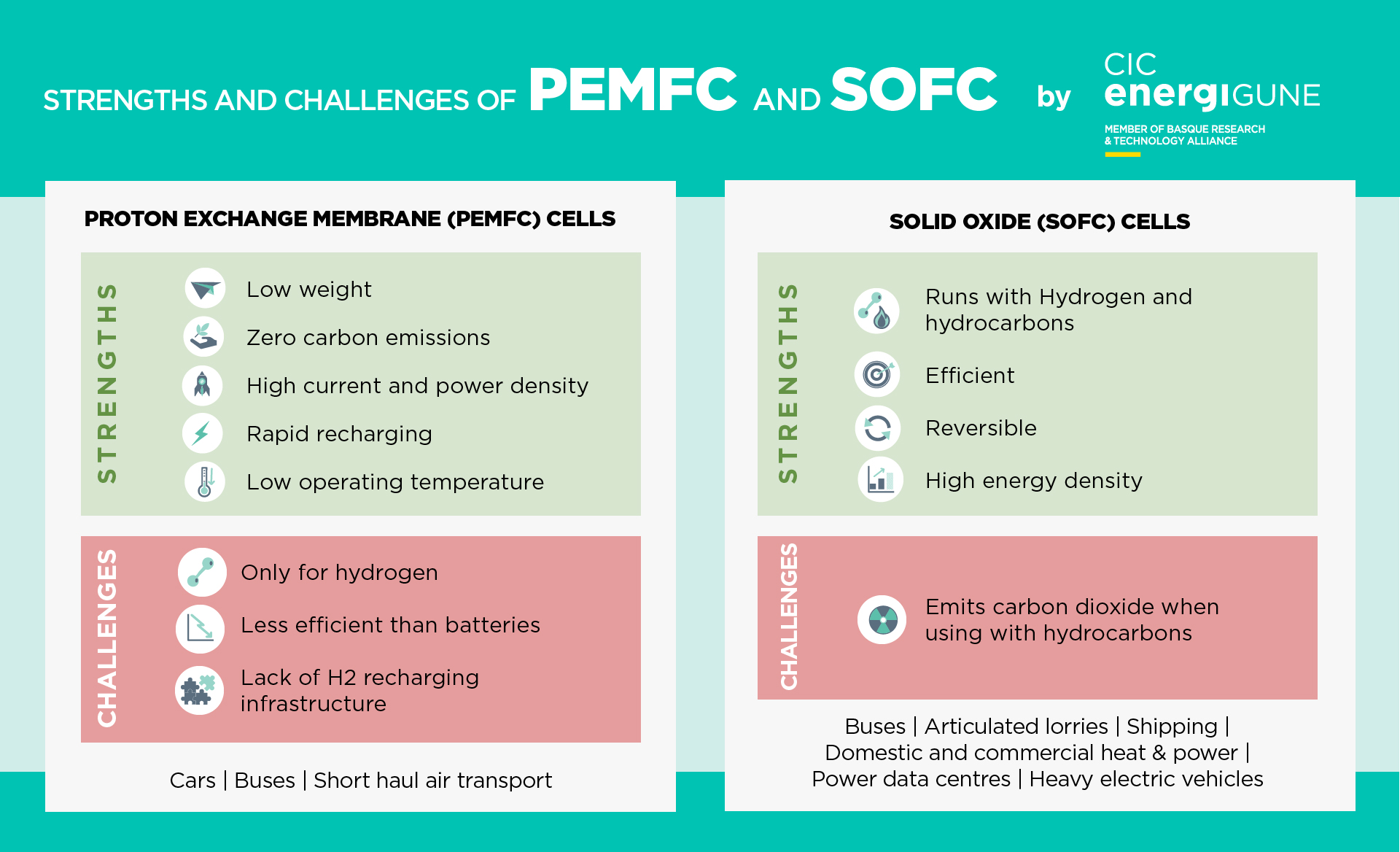

Although there are different technologies associated with these cells, two are the alternatives that have shown the best results and most significant potential to date.

On the one hand, there are the Proton Exchange Membrane cells (also known as PEMFC), characterized by their ability to operate at low temperature, their high current and power density, their flexibility and the fact that they are a compact means of energy generation.

On the other hand, there are solid oxide fuel cells (SOFC) that get their name from using a solid oxide material as an electrolyte. In this case, its high efficiency and high density are two great strengths that place them as a potential alternative in the future.

In the automotive sector, both can allow the proliferation of emission-free vehicles with a long-range (it is estimated that one kilo of hydrogen can travel about 100 km) and also with the advantage of having a quick refueling (something that today is a strength compared to other "clean" alternatives such as the electric car).

However, once again, the cost poses a challenge to be overcome in the coming years to achieve greater adoption. They require large-scale production (in this case, of the fuel cell itself) to achieve levels of profitability that make the adoption of these technologies attractive. However, it is expected that the cheapening of the rest of the value chain and its impact at this stage will gradually reduce this aspect.

In addition, it is also working on improving their safety due to the operating temperatures that this type of technology can reach.

However, the efficiency obtained by both alternatives is a great challenge to be overcome in order to make the use of these technologies more popular. This is the case, for example, of vehicles powered by hydrogen, which can not compete with future alternatives such as batteries.

According to an analysis carried out by the European Federation for Transport and Environment, the efficiency of electric vehicles today is almost 50 percentage points higher than that of fuel-cell cars (77% and 29% respectively). In other words, the primary energy needed to move a hydrogen-powered vehicle could move more than 2 battery-powered cars.

Despite these results, it is expected that in the coming years, the efficiency of hydrogen as a fuel will increase thanks to the advances and bets being made by companies such as Hyundai or Toyota, which are already working on increasing their fleets of hydrogen fuel cell cars for the coming years.