Therefore, many of the world´s leading countries are seeking to position themselves in this sector, taking advantage of the "perfect storm" that currently exists for the implementation of these emerging energy sources, and thanks to figures such as the Paris environmental agreements and the economic subsidies expected as a result of major recovery plans such as the European funds.

Spain is no exception and has been working, in the last few months, with the aim of becoming a hub of reference worldwide.

Thus, recently, the Spanish government has approved both the hydrogen roadmap (which seeks to promote 8,900 million in investments until 2030 in this technology, being the European country that will allocate the largest amount after Italy´s 10,000 million) and the energy storage strategy (in which hydrogen plays a key role). With them, it is intended to define a context that encourages and accelerates the development of hydrogen at the state level.

Such is its ambition in this sector, that the Government itself has committed, among other things, to have an electrolyzer capacity of 4GW, which would represent 10% of the European total expected for that year, making it the fourth country with the largest planned capacity in the European continent.

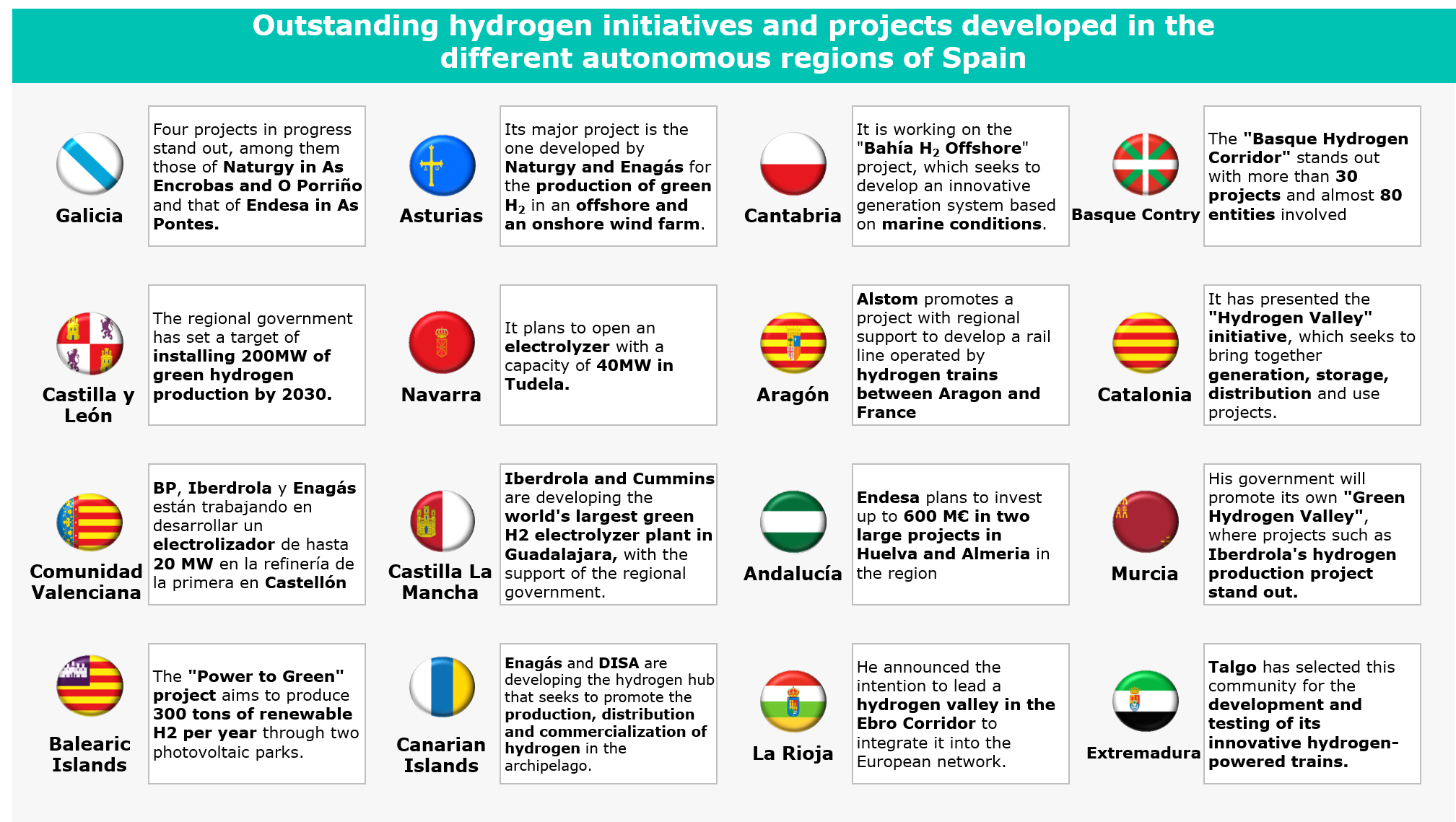

This challenge has been taken up by both the country´s large companies and the regional governments who, taking advantage of the favorable context and the expected investments, have been announcing, in recent months, ambitious plans and projects (many of them public-private partnerships) that will spearhead Spain´s aspirations in terms of hydrogen technologies.

Large companies seek to lead the change

One of the levers on which Spain is relying to achieve its objectives is the great interest shown by the country´s large energy companies in hydrogen technologies.

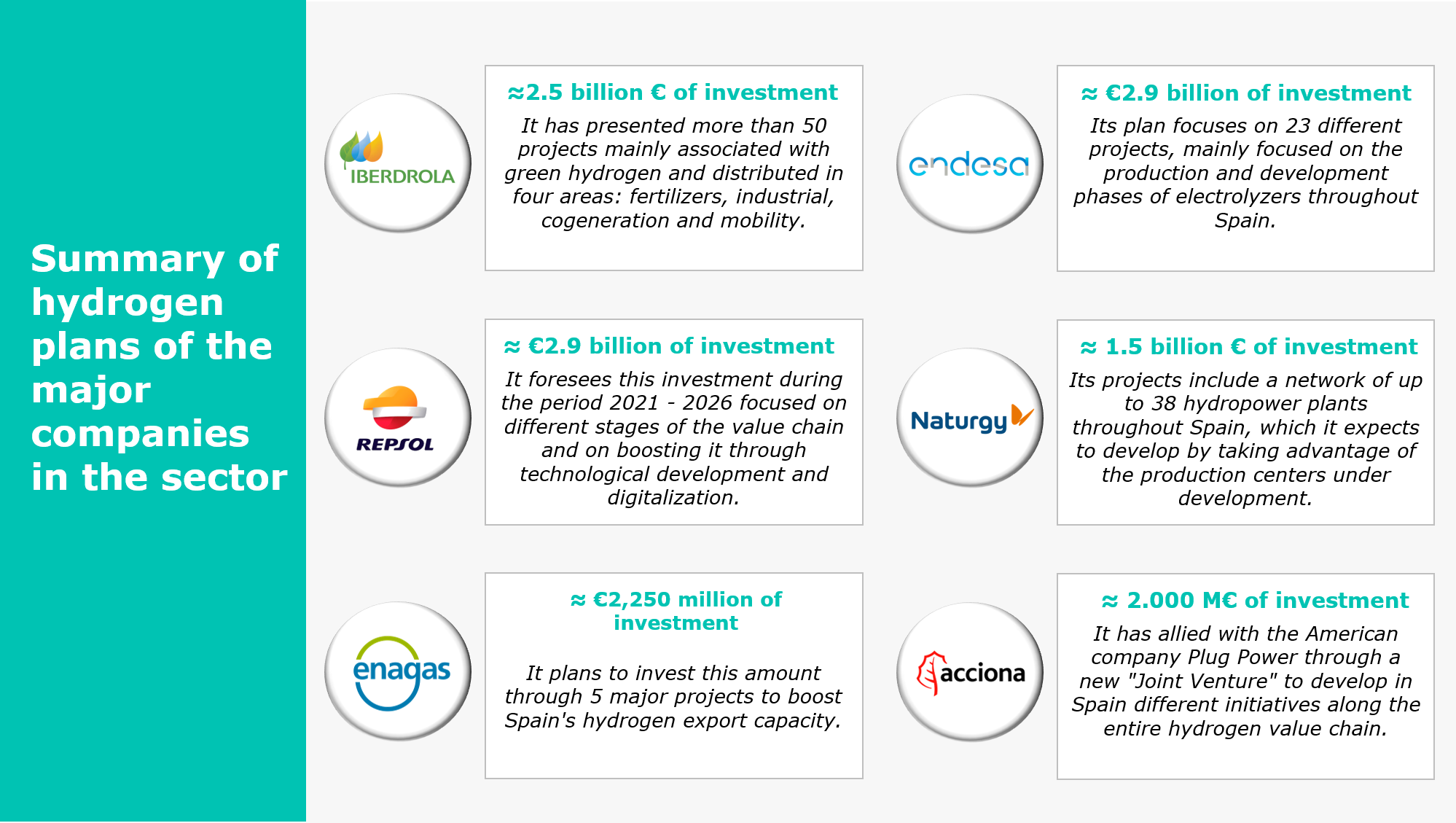

Some examples of companies that have already announced their interest in the sector and investment plans are Iberdrola, Endesa, Repsol, Naturgy and Enagás. Above all, the first two stand out, not only in the race towards the transition to hydrogen, but also in attracting European funds to finance their ambitious plans (which go beyond this technology).

Thus, the Basque-based company is already working (among others) on projects such as an electrolyzer plant in Guadalajara operational by 2023; on plants for the production of green ammonia together with Fertiberia from 2021 onwards; or on the launch of "hydrogenerators" in the three Basque regional capitals powered by three photovoltaic plants (with the aim of encouraging self-consumption).

Endesa announced last February up to 23 projects under study associated with green hydrogen with an estimated investment of 2,900 million euros. Among them, stands out the one already underway in As Pontes (A Coruña), which seeks to implement a 100 MW electrolyzer and 6 associated wind farms by 2023. Other outstanding electrolyzer projects are those of Huelva (with a capacity of 100 MW and an investment of 413 M€), Teruel (60 MW and 294 M€), Almeria (20 MW and 187 M€) and Tarragona (20 MW and 181 M€).

Another big bet on hydrogen is the one proposed by Repsol through Petronor. In fact, one of the major hydrogen initiatives currently in place in Spain is known as the "Basque Hydrogen Corridor", led by Repsol and Petronor; it includes more than 30 different projects throughout the value chain with the participation of up to 78 companies and entities (including CIC energiGUNE).

Among other projects, Repsol and Petronor seek to establish up to 3 renewable hydrogen production plants that will have a cumulative capacity of more than 110 MW once all three are operational in 2025.

In the same vein, other large companies have begun to develop their own hydrogen-related projects. Among others, Enagás, which has announced more than 10 projects associated with this technology, with an expected investment of up to 2,250 million until 2023; Naturgy, which is working with Enagás itself on the development of various hydrogen production projects, for example in León and Asturias; and Acciona, with such innovative projects as OCEANH2, whose objective is the design and validation of the first offshore green hydrogen generation, storage and distribution plant in Spain.